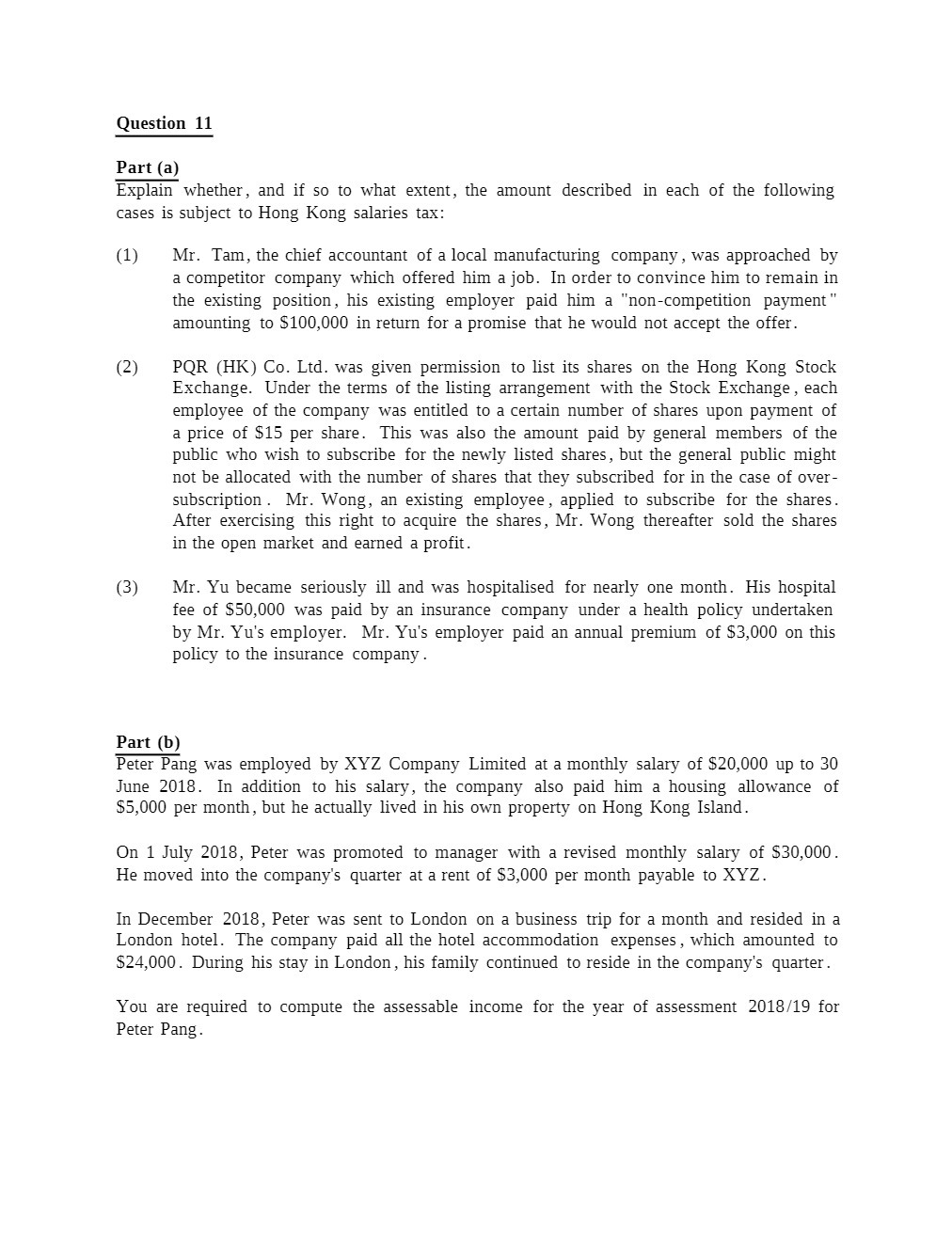

Question: Question 11 Part (a) Explain whether, and if so to what extent, the amount described in each of the following cases is subject to Hong

Question 11 Part (a) Explain whether, and if so to what extent, the amount described in each of the following cases is subject to Hong Kong salaries tax: (1) Mr. Tam, the chief accountant of a local manufacturing company, was approached by a competitor company which offered him a job. In order to convince him to remain in the existing position, his existing employer paid him a "noncompetition payment'r amounting to $100,000 in return for a promise that he would not accept the offer. (2) PQR (HR) Co. Ltd. was given permission to list its shares on the Hong Kong Stock Exchange. Under the terms of the listing arrangement with the Stock Exchange , each employee of the company was entitled to a certain number of shares upon payment of a price of $15 per share. This was also the amount paid by general members of the public who wish to subscribe for the newly listed shares, but the general public might not be allocated with the number of shares that they subscribed for in the case of over subscription. Mr. Wong, an exisu'ng employee , applied to subscribe for the shares. After exercising this right to acquire the shares, Mr. Wong thereafter sold the shares in the open market and earned a profit. (3) Mr. Yu became seriously ill and was hospitalised for nearly one month. His hospital fee of $50,000 was paid by an insurance company under a health policy undertaken by Mr. Yu's employer. Mr. Yu's employer paid an annual premium of $3,000 on this policy to the insurance company. Part (b) Peter Pang was employed by XYZ Company Limited at a monthly salary of $20,000 up to 30 June 2018. In addition to his salary, the company also paid him a housing allowance of $5,000 per month, but he actually lived in his own property on Hong Kong Island. On 1 July 2018, Peter was promoted to manager with a revised monthly saiaiy of $30,000. He moved into the company's quarter at a rent of $3,000 per month payable to XYZ. In December 2018, Peter was sent to London on a business trip for a month and resided in a London hotel. The company paid all the hotel accommodation expenses , which amounted to $24,000. During his stay in London , his family continued to reside in the company's quarter. You are required to compute the assessable income for the year of assessment 2018119 for Peter Pang