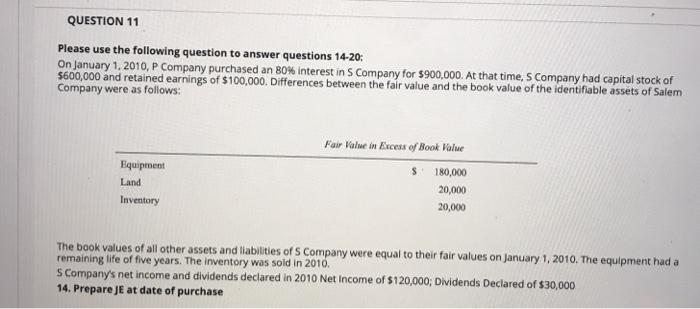

Question: QUESTION 11 Please use the following question to answer questions 14-20 On January 1, 2010, P Company purchased an 80% interest in s Company for

QUESTION 11 Please use the following question to answer questions 14-20 On January 1, 2010, P Company purchased an 80% interest in s Company for $900.000. At that time, Company had capital stock of $600,000 and retained earnings of $100,000. Differences between the fair value and the book value of the identifiable assets of Salem Company were as follows: Equipment Land Inventory Fair Value in Excess of Book Value $ 180,000 20,000 20,000 The book values of all other assets and liabilities of S Company were equal to their fair values on January 1, 2010. The equipment had a remaining life of five years. The inventory was sold in 2016, S Company's net income and dividends declared in 2010 Net Income of $120,000; Dividends Declared of $30,000 14. Prepare Je at date of purchase QUESTION 13 16. Prepare WIP to allocate the differences (see above question) TTT Artal 3(1201) T. Path:p Words: QUESTION 15 18. Prepare W/P entries to eliminate Dividends and convert cost to equity (see above question) TTT Arial 3 (12pt) #T. Path:p Word QUESTION 16 19. Prepare W/P entry to eliminate the equity of Sand investment of Pat 12/31 (see above question) TT T Arial (12pt). T. QUESTION 17 20. Prepare W/P to allocate differences (all inventory has been sold), and the extra depreciation entry (see above question) TT T Arial 3 (121)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts