Question: QUESTION 11 Present Value #1 Congratulations! You were given a lottery ticket. The ticket contained the winning number. The prize is worth $60 million. You

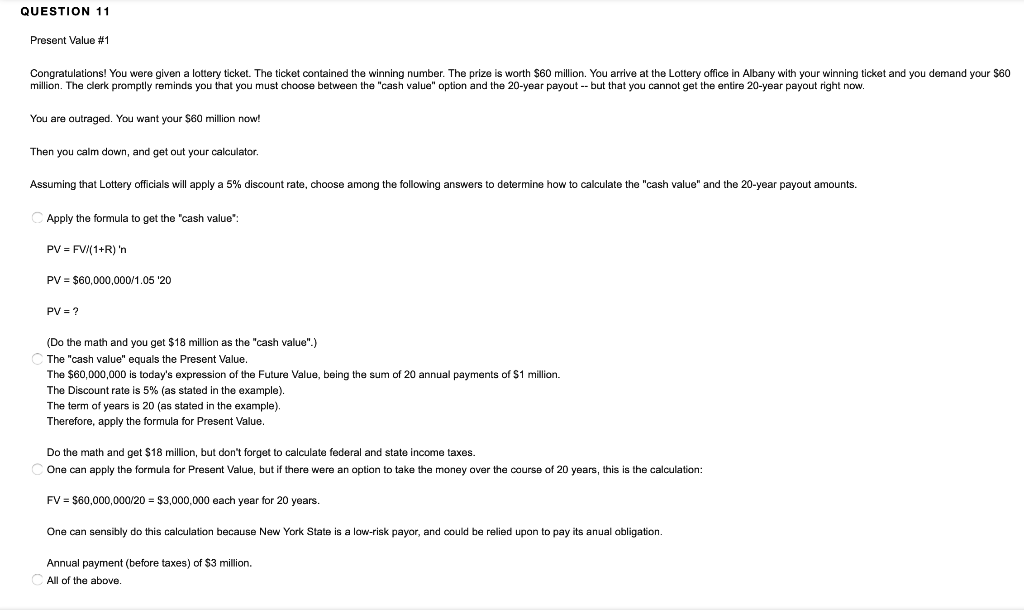

QUESTION 11 Present Value #1 Congratulations! You were given a lottery ticket. The ticket contained the winning number. The prize is worth $60 million. You arrive at the Lottery office in Albany with your winning ticket and you demand your $60 million. The clerk promptly reminds you that you must choose between the "cash value" option and the 20-year payout -- but that you cannot get the entire 20-year payout right now. You are outraged. You want your $60 million now! Then you calm down, and get out your calculator. Assuming that Lottery officials will apply a 5% discount rate, choose among the following answers to determine how to calculate the "cash value" and the 20-year payout amounts. Apply the formula to get the "cash value PV = FV/(1+R) 'n PV = $60,000,000/1.05 20 PV = ? (Do the math and you get $18 million as the "cash value".) The "cash value" equals the Present Value. The $60,000,000 is today's expression of the Future Value, being the sum of 20 annual payments of $1 million. The Discount rate is 5% (as stated in the example). The term years is 20 (as stated in the example) Therefore, apply the formula for Present Value. Do the math and get $18 million, but don't forget to calculate federal and state income taxes. One can apply the formula for Present Value, but if there were an option to take the money over the course of 20 years, this is the calculation: FV = $60,000,000/20 = $3,000,000 each year for 20 years. One can sensibly do this calculation because New York State is a low-risk payor, and could be relied upon to pay its anual obligation. Annual payment (before taxes) of $3 million. All of the above. QUESTION 11 Present Value #1 Congratulations! You were given a lottery ticket. The ticket contained the winning number. The prize is worth $60 million. You arrive at the Lottery office in Albany with your winning ticket and you demand your $60 million. The clerk promptly reminds you that you must choose between the "cash value" option and the 20-year payout -- but that you cannot get the entire 20-year payout right now. You are outraged. You want your $60 million now! Then you calm down, and get out your calculator. Assuming that Lottery officials will apply a 5% discount rate, choose among the following answers to determine how to calculate the "cash value" and the 20-year payout amounts. Apply the formula to get the "cash value PV = FV/(1+R) 'n PV = $60,000,000/1.05 20 PV = ? (Do the math and you get $18 million as the "cash value".) The "cash value" equals the Present Value. The $60,000,000 is today's expression of the Future Value, being the sum of 20 annual payments of $1 million. The Discount rate is 5% (as stated in the example). The term years is 20 (as stated in the example) Therefore, apply the formula for Present Value. Do the math and get $18 million, but don't forget to calculate federal and state income taxes. One can apply the formula for Present Value, but if there were an option to take the money over the course of 20 years, this is the calculation: FV = $60,000,000/20 = $3,000,000 each year for 20 years. One can sensibly do this calculation because New York State is a low-risk payor, and could be relied upon to pay its anual obligation. Annual payment (before taxes) of $3 million. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts