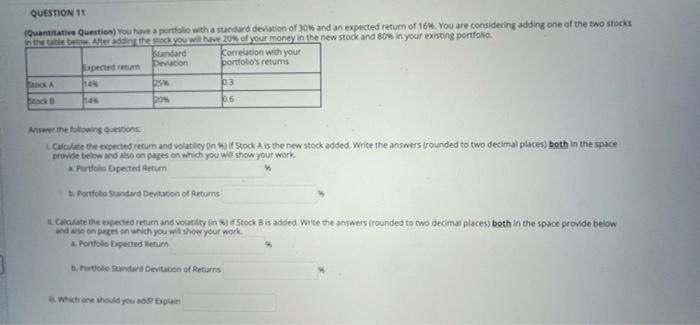

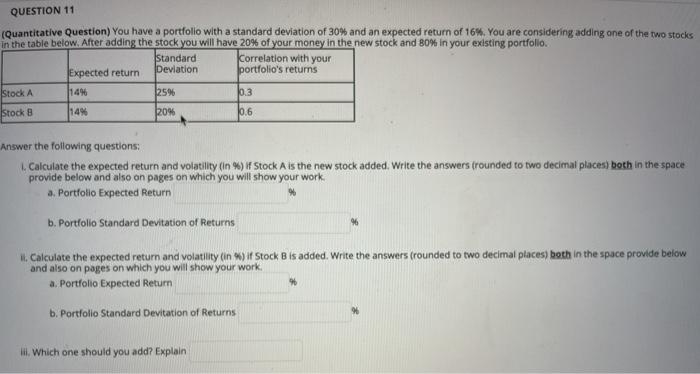

Question: QUESTION 11 Quantitative Question) you have a portfolio with a standard deviation of 30 and an expected return of 16. You are considering adding one

QUESTION 11 Quantitative Question) you have a portfolio with a standard deviation of 30 and an expected return of 16. You are considering adding one of the two stocks the table bronnen the sock you will have 20% of your money in the new stock and 80% in your existing portfolio keandard Korrelation with your pected return Deacon portfoto's returns Benda 3 bow 06 Answer the following on Celolate the expected retum and volatbey On It Stock Ais the new stock added write the answers (rounded to two decimal places) both in the space provide below and also on pages on which you will show your work Portfolio Expected Return b. Portfolio Standard Devitation of Returns tardate the expected return and outlity in Wit Stock is added Write the answers rounded to two decimal places) both in the space provide below and also on pages on which you will show your work Porto Expected Return Portfolio Standard deviation of Returns Wschone should you blin QUESTION 11 (Quantitative Question) You have a portfolio with a standard deviation of 30% and an expected return of 164. You are considering adding one of the two stocks in the table below. After adding the stock you will have 20% of your money in the new stock and 80% in your existing portfolio Standard Correlation with your Expected return Deviation portfolio's returns Stock A 125% Stock B 14% 1440 10.3 10% 10.6 Answer the following questions: Calculate the expected return and volatillty (in %) if Stock A is the new stock added. Write the answers (rounded to two decimal places, both in the space provide below and also on pages on which you will show your work a. Portfolio Expected Return b. Portfolio Standard Devitation of Returns 1. Calculate the expected return and volatility (in %) if Stock Bis added. Write the answers (rounded to two decimal places) both in the space provide below and also on pages on which you will show your work. a. Portfolio Expected Return b. Portfolio Standard Devitation of Returns . Which one should you add? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts