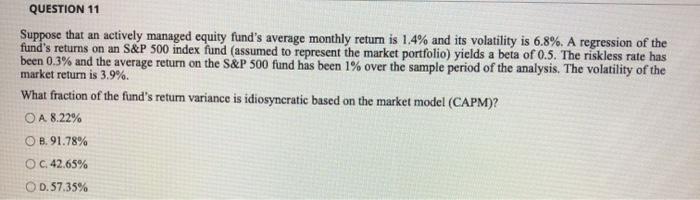

Question: QUESTION 11 Suppose that an actively managed equity fund's average monthly return is 1.4% and its volatility is 6.8%. A regression of the fund's returns

QUESTION 11 Suppose that an actively managed equity fund's average monthly return is 1.4% and its volatility is 6.8%. A regression of the fund's returns on an S&P 500 index fund (assumed to represent the market portfolio) yields a beta of 0.5. The riskless rate has been 0.3% and the average return on the S&P 500 fund has been 1% over the sample period of the analysis. The volatility of the market return is 3.9%. What fraction of the fund's retum variance is idiosyncratic based on the market model (CAPM)? O A 8.22% O B.91.78% O C. 42.65% OD. 57.35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts