Question: QUESTION 11 The components of internal controls include: O a. All of the above O b. Control activities O c. Monitoring O d. Information and

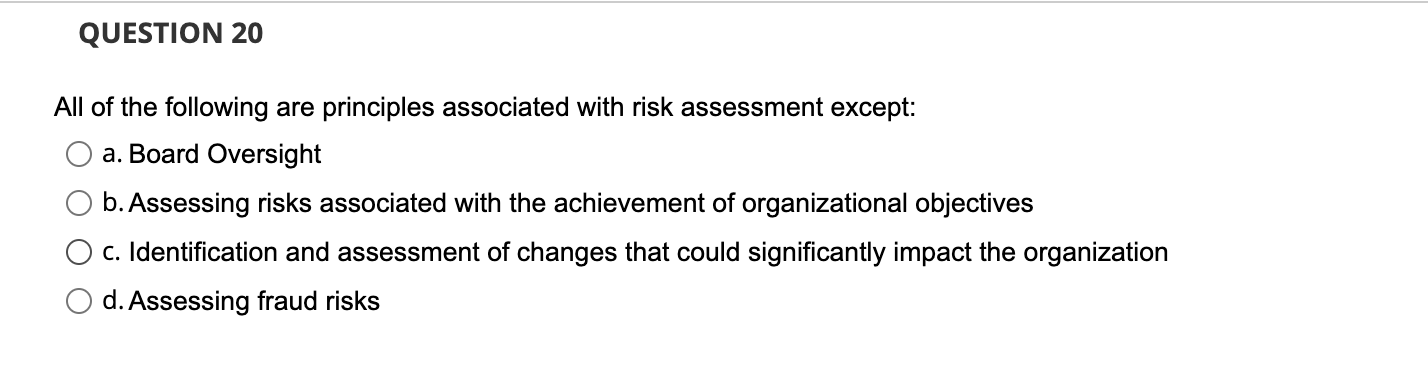

QUESTION 11 The components of internal controls include: O a. All of the above O b. Control activities O c. Monitoring O d. Information and communication QUESTION 12 Which of the following is not a sanction available to the SEC when auditors found to be unqualified, unethical, or in willful violation of any provision of the federal securities laws can be disciplined by the SEC? O a. Suspending individuals from serving as officers or directors of securities issuers or participating in the securities industry O b. Imposing civil monetary penalties O c. Requiring special continuing education of firm personnel O d. Six months public serviceQUESTION 13 The shareholders of a bank sue Karen Frank, CPA, for malpractice due to an audit failure that preceded the bank's financial failure. The jury determines that Frank is 60% at fault and that management is 40% at fault. The bank has no financial resources, nor does its management. Under joint and several liability, what is the likely percentage of damages that Frank will ensue? O a. 100% O b. 40% O c. 50% O d. None of these QUESTION 14 An audit program details the audit procedures to be completed before providing the audit opinion(s). True O FalseQUESTION 15 The parties that can intervene in a disagreement between the auditor and the client (organization) include: I. Audit Committee ll. Investors lll. Creditors O a. I, II and III 0 b.| O c. II and III 0 d.| and II QUESTION 16 Audit failure can lead to auditor liability but not audit rm liability. 0 True 0 False QUESTION 17 Which of the following factors is not a reason that audit rms experience litigation for business failures. rather than audit failures? 0 a. Contingent-fee compensation for audit rms 0 b. Joint and several liability statutes 0 c. Class action lawsuits O d.A misunderstanding by some users that an unqualified audit opinion represents an insurance policy against investment losses QUESTION 18 If the auditor determines that there is a signicant amount of subjectivity in the accounting process, the auditor would: 0 a. The auditor would conduct a more rigorous substantive testing 0 b. The auditor would assess control risk at low O c. The auditor would decide against conducting control testing 0 d. The auditor would assess inherent risk as high QUESTION 19 Public company management biases can pose a threat to the credibility of financial statements. 0 True 0 False QUESTION 20 All of the following are principles associated with risk assessment except: 0 a. Board Oversight O b.Assessing risks associated with the achievement of organizational objectives 0 c. Identification and assessment of changes that could significantly impact the organization 0 d.Assessing fraud risks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts