Question: Question 11 The difference between a forward contract (in currency) and a futures contract (in currency) is that futures contract is customized to the buyer's

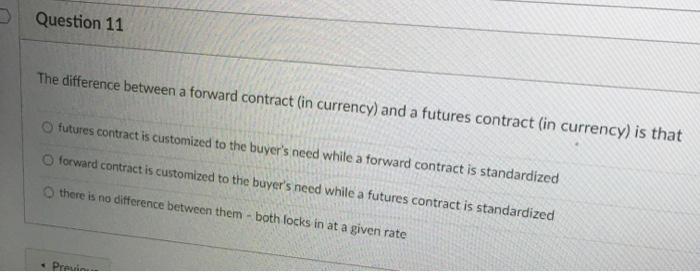

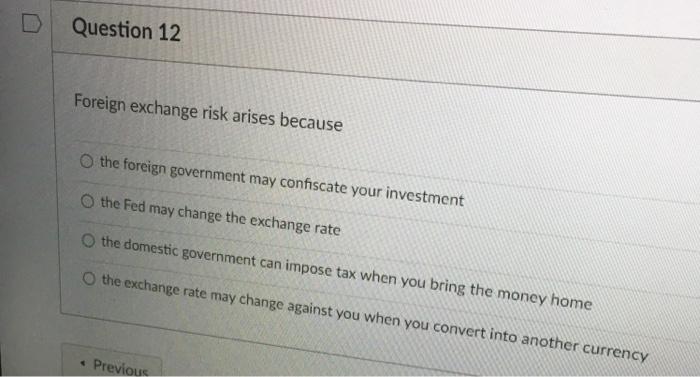

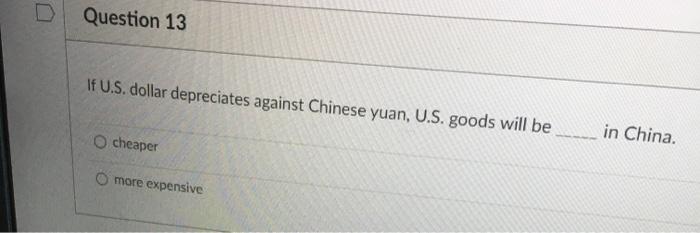

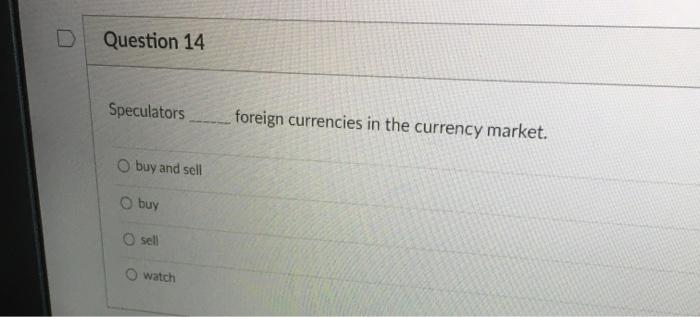

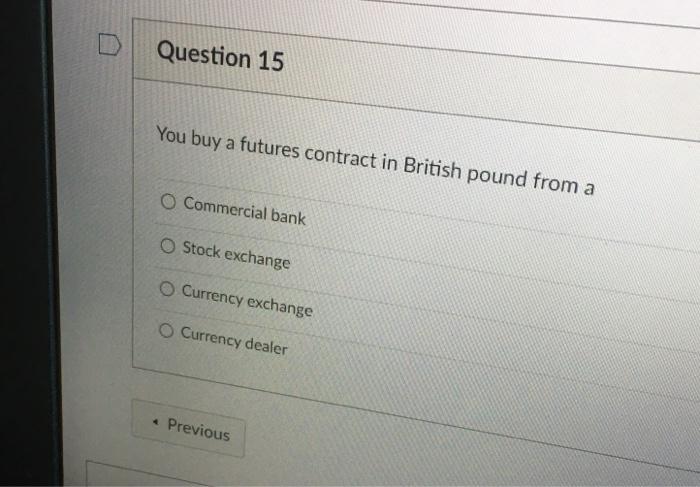

Question 11 The difference between a forward contract (in currency) and a futures contract (in currency) is that futures contract is customized to the buyer's need while a forward contract is standardized forward contract is customized to the buyer's need while a futures contract is standardized there is no difference between them - both locks in at a given rate Pratis Question 12 Foreign exchange risk arises because the foreign government may confiscate your investment the Fed may change the exchange rate the domestic government can impose tax when you bring the money home the exchange rate may change against you when you convert into another currency Previous Question 13 If U.S. dollar depreciates against Chinese yuan, U.S. goods will be in China. cheaper more expensive D Question 14 Speculators foreign currencies in the currency market. buy and sell O buy o sell watch Question 15 You buy a futures contract in British pound from a Commercial bank O Stock exchange Currency exchange Currency dealer Previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts