Question: QUESTION 11 The factor F in the APT model represents O firm-specific risk. O a factor that affects all security returns. the deviation from its

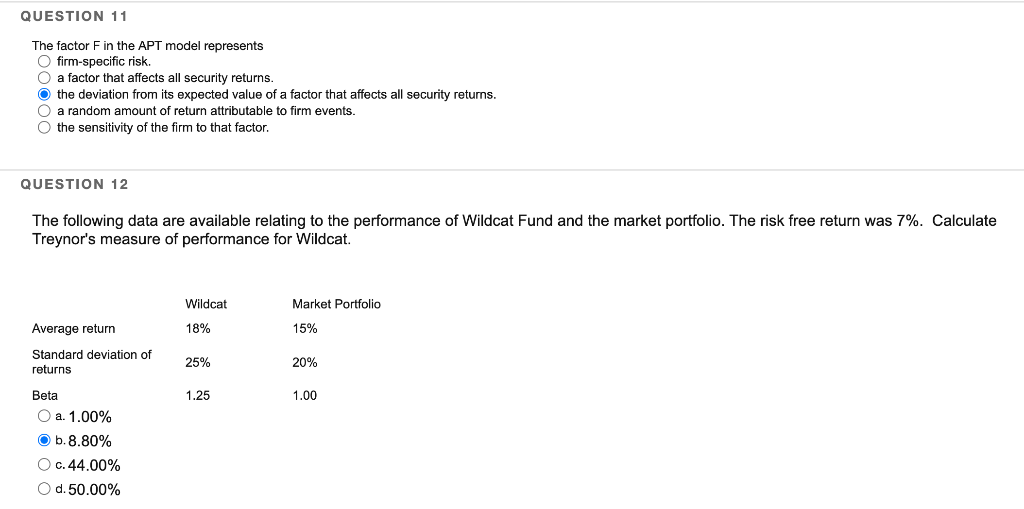

QUESTION 11 The factor F in the APT model represents O firm-specific risk. O a factor that affects all security returns. the deviation from its expected value of a factor that affects all security returns. O a random amount of return attributable to firm events. the sensitivity of the firm to that factor. QUESTION 12 The following data are available relating to the performance of Wildcat Fund and the market portfolio. The risk free return was 7%. Calculate Treynor's measure of performance for Wildcat. Wildcat Market Portfolio Average return 18% 15% Standard deviation of returns 25% 20% 1.25 1.00 Beta a. 1.00% b.8.80% O c. 44.00% O d. 50.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts