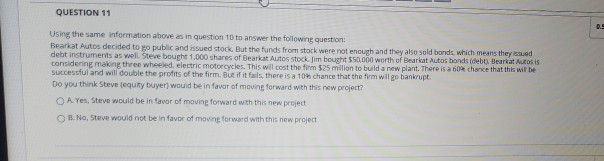

Question: QUESTION 11 Using the same information above as in question 10 to answer the following question: Bearkat Autos decided to go public and issued stock.

QUESTION 11 Using the same information above as in question 10 to answer the following question: Bearkat Autos decided to go public and issued stock. But the funds from stock were not enough and they also sold bonds, which means they wed debt instruments as well. Steve bought 1.000 shares of Bearkat Autos stock. Jim bought 550.000 worth of Bearkat Autos bonds (debt) Bearkat Autosis considering making three wheeled, electric motorcycles. This will cost the firm 525 million to build a new plant. There is a 60% chance that this will be Successful and will double the profits of the firm. But if it falls, there is a 10% chance that the firm will go bankrupt. Do you think Steve equity buyer) would be in favor of moving forward with this new project? A. Yes, Steve would be in favor of moving forward with this new project B. No, Steve would not be in favor of moving forward with this new project QUESTION 11 Using the same information above as in question 10 to answer the following question: Bearkat Autos decided to go public and issued stock. But the funds from stock were not enough and they also sold bonds, which means they wed debt instruments as well. Steve bought 1.000 shares of Bearkat Autos stock. Jim bought 550.000 worth of Bearkat Autos bonds (debt) Bearkat Autosis considering making three wheeled, electric motorcycles. This will cost the firm 525 million to build a new plant. There is a 60% chance that this will be Successful and will double the profits of the firm. But if it falls, there is a 10% chance that the firm will go bankrupt. Do you think Steve equity buyer) would be in favor of moving forward with this new project? A. Yes, Steve would be in favor of moving forward with this new project B. No, Steve would not be in favor of moving forward with this new project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts