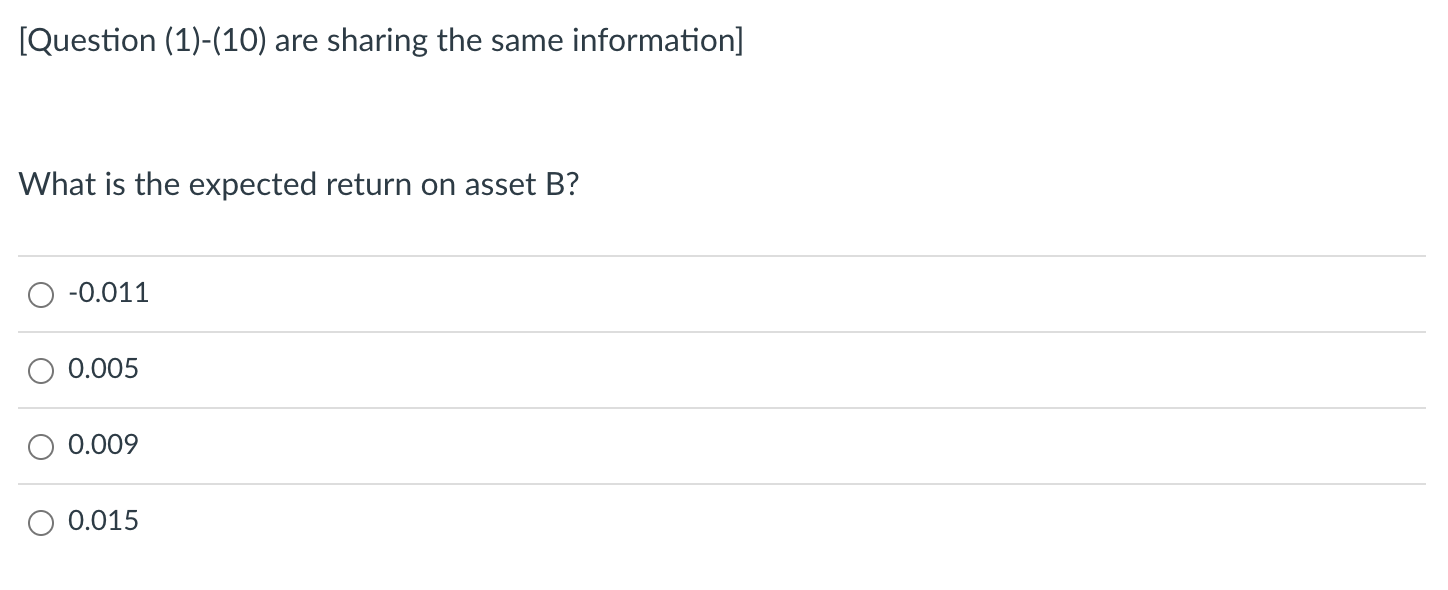

Question: [Question (1)-(10) are sharing the same information] What is the expected return on asset B ? begin{tabular}{l} hline-0.011 hline 0.005 hline 0.009

![[Question (1)-(10) are sharing the same information] What is the expected](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ecf68ccc6a9_64466ecf68c3a741.jpg)

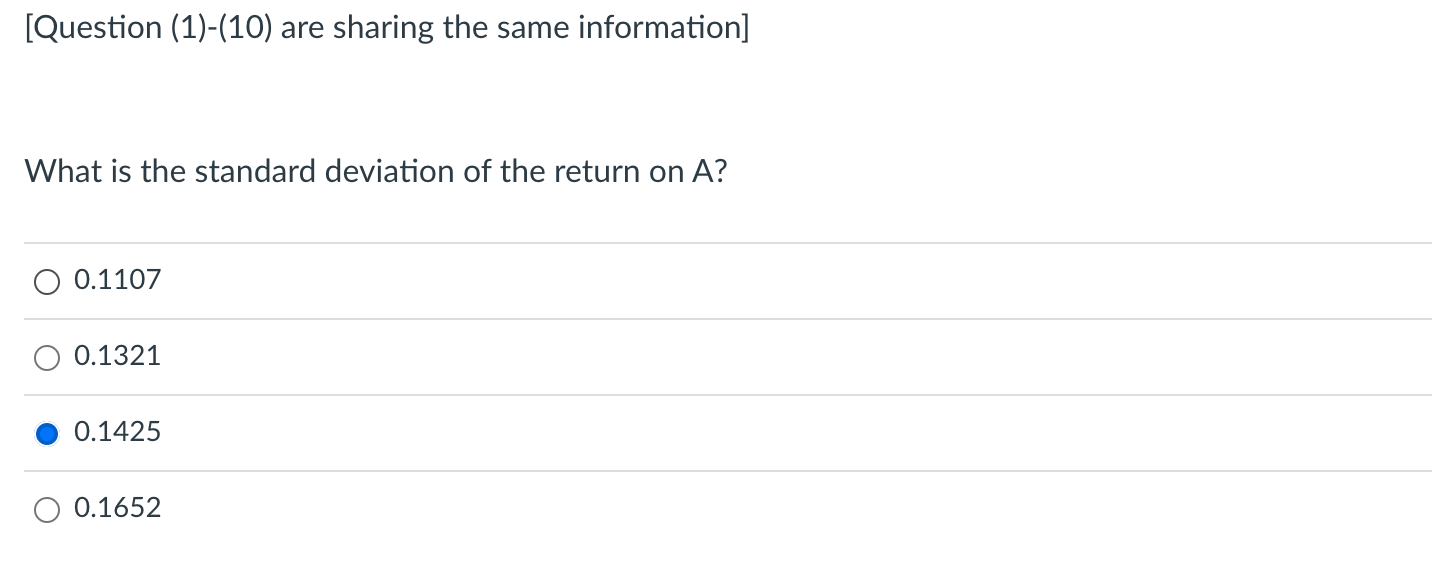

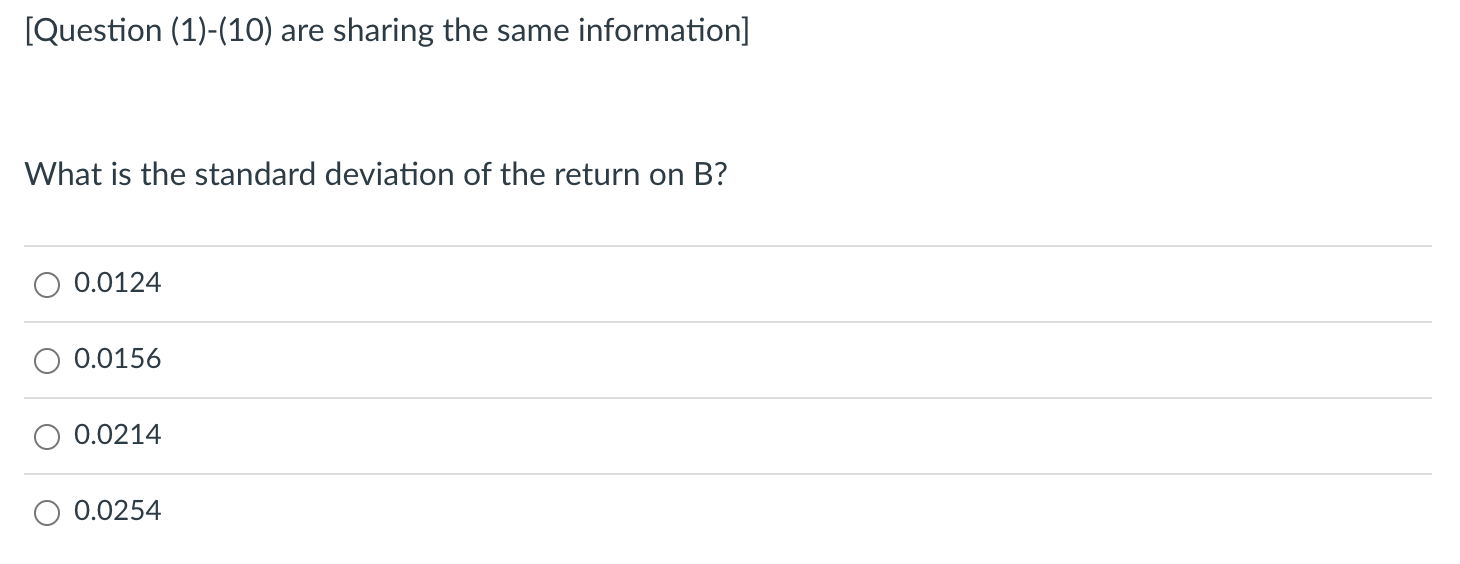

[Question (1)-(10) are sharing the same information] What is the expected return on asset B ? \begin{tabular}{l} \hline-0.011 \\ \hline 0.005 \\ \hline 0.009 \\ \hline 0.015 \end{tabular} Questions 1-10 are designed to review some statistical concepts as well as to help you understand the benefits from diversification. Assume that there are two assets ( A and B ) and there are four possible future scenarios. The four scenarios and their probabilities are shown in the following table. The last two columns show the returns on assets A and B in the four possible scenarios. What is the expected return on asset A ? [Question (1)-(10) are sharing the same information] What is the standard deviation of the return on B ? \begin{tabular}{l} \hline 0.0124 \\ \hline 0.0156 \\ \hline 0.0214 \\ \hline 0.0254 \end{tabular} [Question (1)-(10) are sharing the same information] What is the standard deviation of the return on A ? \begin{tabular}{l} \hline 0.1107 \\ \hline 0.1321 \\ \hline 0.1425 \\ \hline 0.1652 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts