Question: Question 11.1 Replacement Basics without Considering Income Tax Effects (a) If the truck is to be sold now, what will be its sunk cost? (b)

Question 11.1

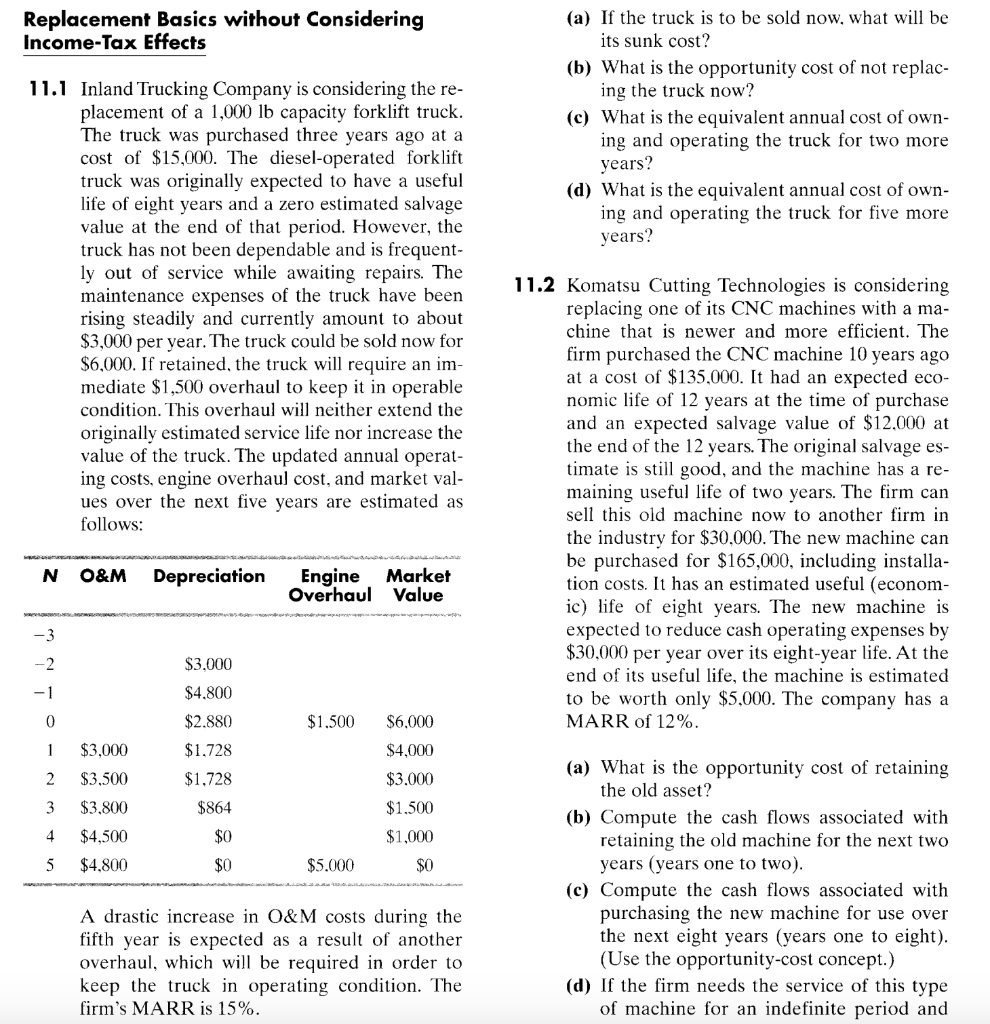

Replacement Basics without Considering Income Tax Effects (a) If the truck is to be sold now, what will be its sunk cost? (b) What is the opportunity cost of not replac- ing the truck now? (c) What is the equivalent annual cost of own- ing and operating the truck for two more years? (d) What is the equivalent annual cost of own- ing and operating the truck for five more years? 11.1 Inland Trucking Company is considering the re- placement of a 1,000 lb capacity forklift truck. The truck was purchased three years ago at a cost of $15,000. The diesel-operated forklift truck was originally expected to have a useful life of eight years and a zero estimated salvage value at the end of that period. However, the truck has not been dependable and is frequent- ly out of service while awaiting repairs. The maintenance expenses of the truck have been rising steadily and currently amount to about $3,000 per year. The truck could be sold now for $6,000. If retained, the truck will require an im- mediate $1,500 overhaul to keep it in operable condition. This overhaul will neither extend the originally estimated service life nor increase the value of the truck. The updated annual operat- ing costs, engine overhaul cost, and market val- ues over the next five years are estimated as follows: 11.2 Komatsu Cutting Technologies is considering replacing one of its CNC machines with a ma- chine that is newer and more efficient. The firm purchased the CNC machine 10 years ago at a cost of $135.000. It had an expected eco- nomic life of 12 years at the time of purchase and an expected salvage value of $12.000 at the end of the 12 years. The original salvage es- timate is still good, and the machine has a re- maining useful life of two years. The firm can sell this old machine now to another firm in the industry for $30,000. The new machine can be purchased for $165,000, including installa- tion costs. It has an estimated useful (econom- ic) life of eight years. The new machine is expected to reduce cash operating expenses by $30,000 per year over its eight-year life. At the end of its useful life, the machine is estimated to be worth only $5,000. The company has a MARR of 12%. N O&M Depreciation Engine Market Overhaul Value $1.500 $3,000 $4,800 $2.880 $1.728 $1,728 $864 1 2 3 4 5 $3,000 $3,500 $3,800 $4,500 $4.800 $6.000 $4.000 $3.000 $1.500 $1,000 $0 $0 $5.000 (a) What is the opportunity cost of retaining the old asset? (b) Compute the cash flows associated with retaining the old machine for the next two years (years one to two). (c) Compute the cash flows associated with purchasing the new machine for use over the next eight years (years one to eight). (Use the opportunity-cost concept.) (d) If the firm needs the service of this type of machine for an indefinite period and A drastic increase in O&M costs during the fifth year is expected as a result of another overhaul, which will be required in order to keep the truck in operating condition. The firm's MARR is 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts