Question: Question 111: What am I doing wrong? My work below. What the professor says the answer is: 0329 11 1. A portfolio has 40% of

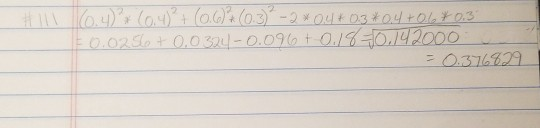

Question 111: What am I doing wrong? My work below.

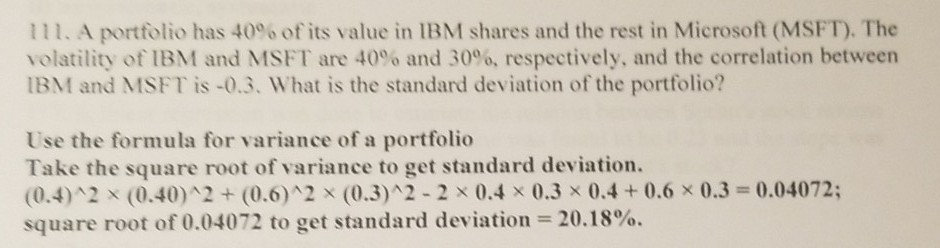

What the professor says the answer is:

0329 11 1. A portfolio has 40% of its value in IBM shares and the rest in Microsoft (MSFT), The volatility of IBM and MSFT are 40% and 30%, respectively, and the correlation between IBM and MSFT is -0.3. What is the standard deviation of the portfolio? Use the formula for variance of a portfolio Take the square root of variance to get standard deviation. (0.4)42 (0.40)42 +(0.6)A2 x (0.3)42-2x 0.4 x 0.3 x 0.4+0.6x0.3-0.04072; square root of 0.04072 to get standard deviation 20.18%. O7O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts