Question: Question 119: a) What is the interest for year 2 for the loan? b) what is the payment to principal for the loan at year

Question 119:

a) What is the interest for year 2 for the loan?

b) what is the payment to principal for the loan at year 2?

c) What MARR value do you need to use to evaluate this project once you have the net cash flows?

d) What is the CCA amount for year 1 for the machine?

e) What is the annual revenue amount for year 2?

f) What is the disposal tax amount for the machine?

g) what is the net income amount for year 1? Please post full detailed solutions, thank you.

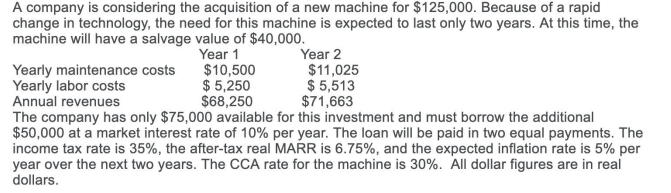

A company is considering the acquisition of a new machine for $125,000. Because of a rapid change in technology, the need for this machine is expected to last only two years. At this time, the machine will have a salvage value of $40,000. Year 1 Year 2 Yearly maintenance costs $10,500 $11,025 Yearly labor costs $5,250 $ 5,513 Annual revenues $68,250 $71,663 The company has only $75,000 available for this investment and must borrow the additional $50,000 at a market interest rate of 10% per year. The loan will be paid in two equal payments. The income tax rate is 35%, the after-tax real MARR is 6.75%, and the expected inflation rate is 5% per year over the next two years. The CCA rate for the machine is 30%. All dollar figures are in real dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts