Question: Question 12 (0.5 points) Inflation-protected CPP and OAS payments are a significant component of Canadian retirement incomes. They must be factored into financial planning targets.

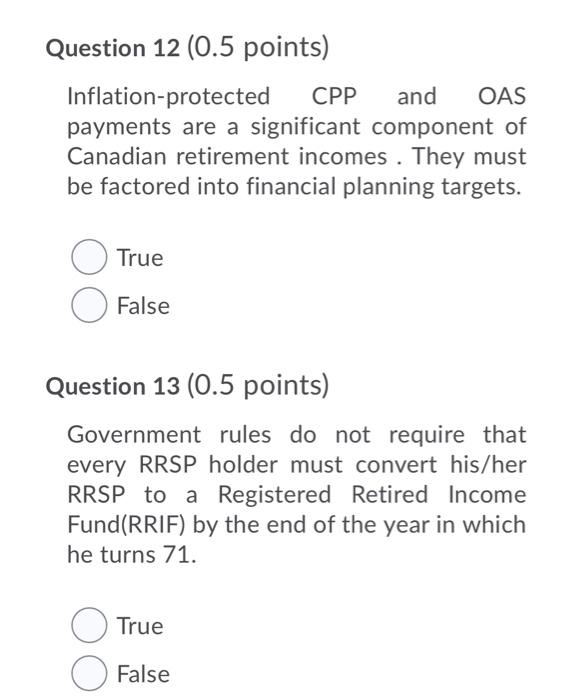

Question 12 (0.5 points) Inflation-protected CPP and OAS payments are a significant component of Canadian retirement incomes. They must be factored into financial planning targets. True False Question 13 (0.5 points) Government rules do not require that every RRSP holder must convert his/her RRSP to a Registered Retired Income Fund(RRIF) by the end of the year in which he turns 71. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts