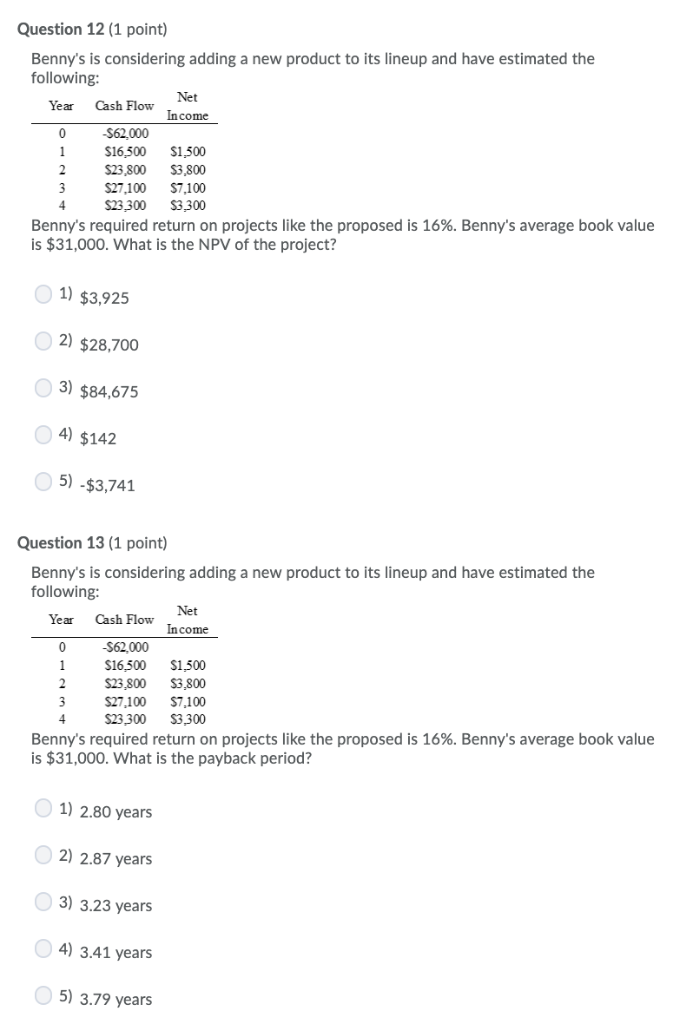

Question: Question 12 (1 point) Benny's is considering addinga new product to its lineup and have estimated the following: Net Year Cash Flow Income -$62.000 $16,500

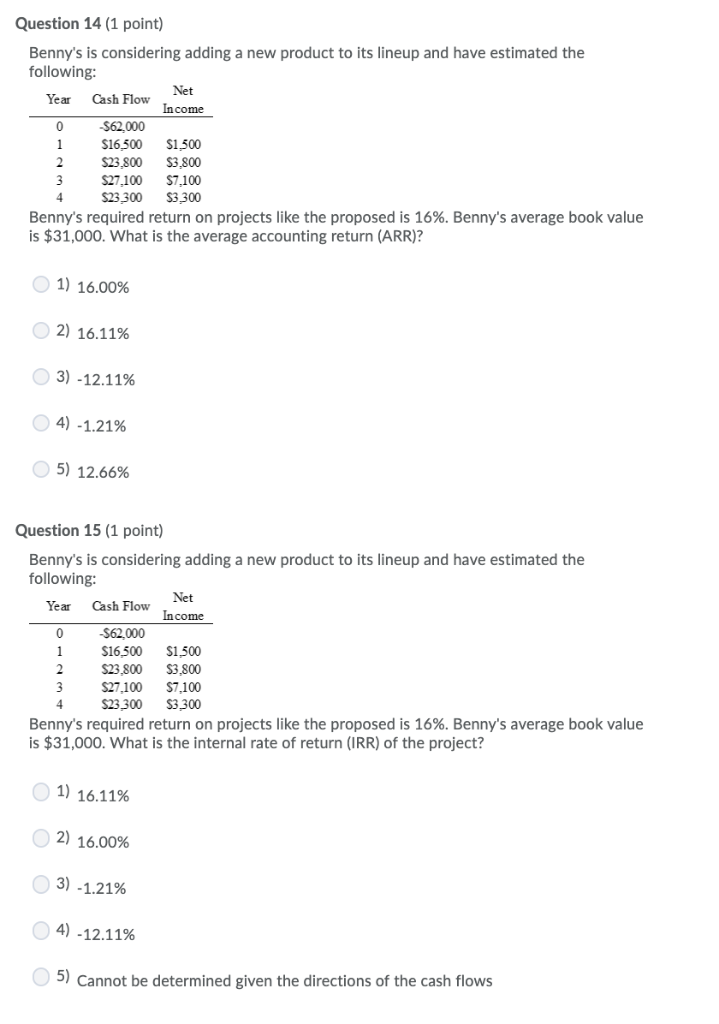

Question 12 (1 point) Benny's is considering addinga new product to its lineup and have estimated the following: Net Year Cash Flow Income -$62.000 $16,500 S1,500 $3,800 1 $23.800 2 3 $27,100 $23,300 $7,100 $3,300 4 Benny's required return on projects like the proposed is 16%. Benny's average book value is $31,000. What is the NPV of the project? O 1) $3,925 2) $28,700 3) $84,675 4) $142 5) -$3,741 Question 13 (1 point) Benny's is considering adding a new product to its lineup and have estimated the following: Net Year Cash Flow Income 0 -$62,000 $16,500 $23,800 $27.100 $23,300 1 $1,500 $3,800 $7,100 2 3 4 $3.300 Benny's required return on projects like the proposed is 16%. Benny's average book value is $31,000. What is the payback period? 1) 2.80 years 2) 2.87 years 3) 3.23 years 4) 3.41 years 5) 3.79 years Question 14 (1 point) Benny's is considering adding a new product to its lineup and have estimated the following: Net Year Cash Flow Income $62.000 $1,500 $16,500 $23,800 $27,100 $23,300 $3.800 2 $7,100 S3,300 4 Benny's required return on projects like the proposed is 16%. Benny's average book value is $31,000. What is the average accounting return (ARR)? 1) 16.00% O 2) 16.11% 3) -12.11 % 4) -1.21% 5) 12.66% Question 15 (1 point) Benny's is considering adding a new product to its lineup and have estimated the following: Net Cash Flow Year Income $62000 1 $16,500 $23,800 S1,500 S3,800 $7,100 $3300 2 $27.100 $23,300 4. Benny's required return on projects like the proposed is 16%. Benny's average book value is $31,000. What is the internal rate of return (IRR) of the project? O 1) 16.11% O 2) 16.00% 3) -1.21% O 4) -12.11 % 5) Cannot be determined given the directions of the cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts