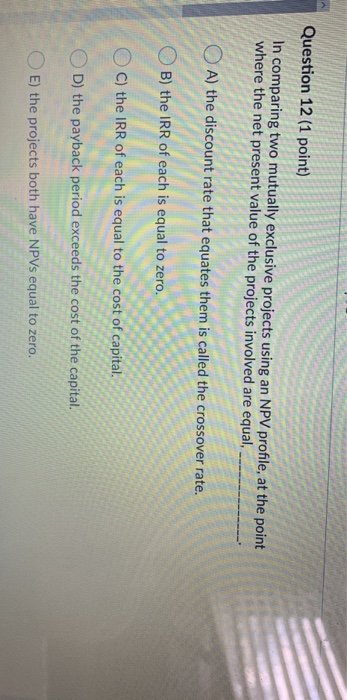

Question: Question 12 (1 point) In comparing two mutually exclusive projects using an NPV profile, at the point where the net present value of the projects

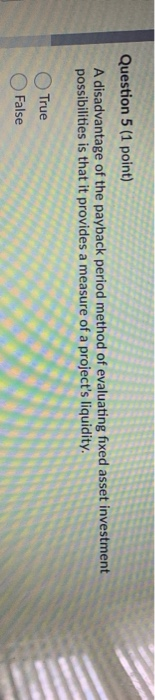

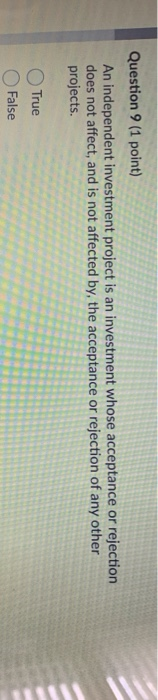

Question 12 (1 point) In comparing two mutually exclusive projects using an NPV profile, at the point where the net present value of the projects involved are equal, A) the discount rate that equates them is called the crossover rate. O B) the IRR of each is equal to zero. C) the IRR of each is equal to the cost of capital. O D) the payback period exceeds the cost of the capital. OE) the projects both have NPVs equal to zero. Question 5 (1 point) A disadvantage of the payback period method of evaluating fixed asset investment possibilities is that it provides a measure of a project's liquidity. roiecte liquidity True False Question 9 (1 point) An independent investment project is an investment whose acceptance or rejection does not affect, and is not affected by the acceptance or rejection of any other projects. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts