Question: Question 12 1 pts A bond with a face value of $1,000 has a current yield of 5% and a coupon rate 6%. If the

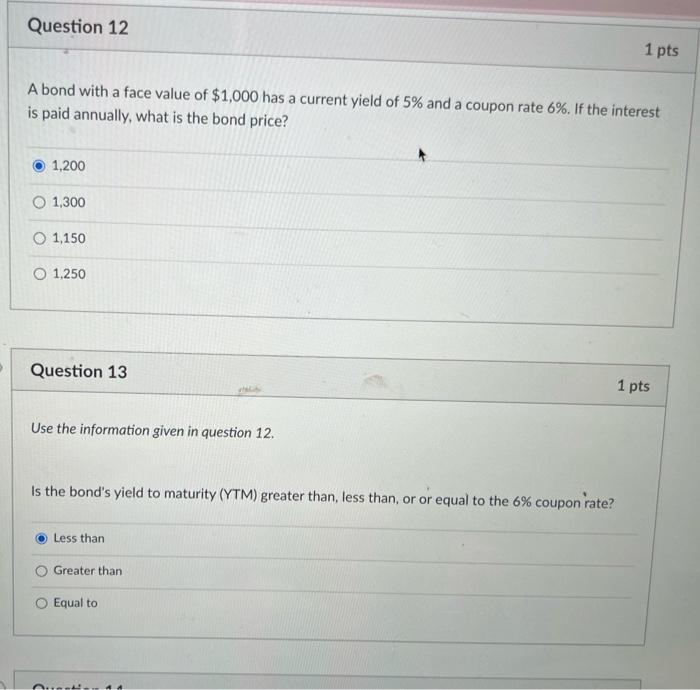

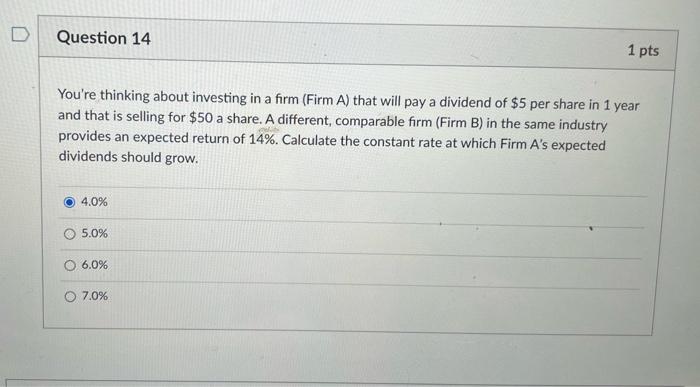

Question 12 1 pts A bond with a face value of $1,000 has a current yield of 5% and a coupon rate 6%. If the interest is paid annually, what is the bond price? 1,200 O 1,300 1,150 O 1,250 Question 13 1 pts Use the information given in question 12. Is the bond's yield to maturity (YTM) greater than, less than, or or equal to the 6% coupon rate? Less than Greater than Equal to D Question 14 1 pts You're thinking about investing in a firm (Firm A) that will pay a dividend of $5 per share in 1 year and that is selling for $50 a share. A different, comparable firm (Firm B) in the same industry provides an expected return of 14%. Calculate the constant rate at which Firm A's expected dividends should grow. 4.0% 5.0% O 6.0% O 7.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts