Question: Question 12 1 pts The next question is based on the following data for a one-period binomial model. . . The stock's price S is

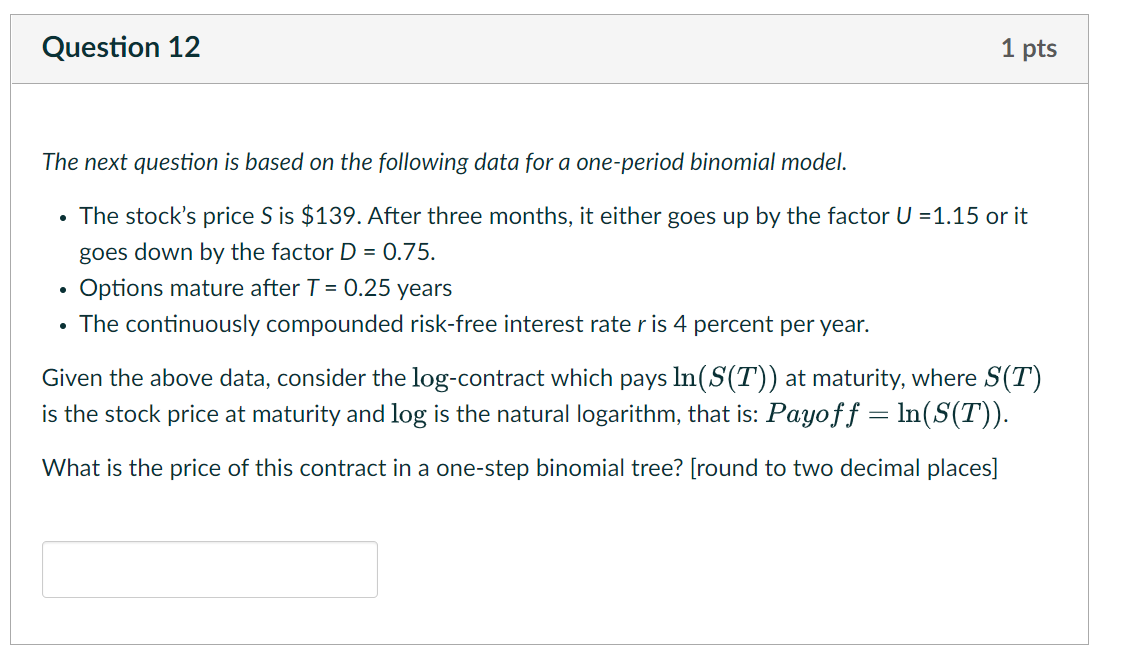

Question 12 1 pts The next question is based on the following data for a one-period binomial model. . . The stock's price S is $139. After three months, it either goes up by the factor U = 1.15 or it goes down by the factor D = 0.75. Options mature after T = 0.25 years The continuously compounded risk-free interest rate r is 4 percent per year. Given the above data, consider the log-contract which pays In(S(T)) at maturity, where S(T) is the stock price at maturity and log is the natural logarithm, that is: Payoff = ln(S(T)). What is the price of this contract in a one-step binomial tree? [round to two decimal places]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts