Question: Question 12 10 points Save Answer Assume zero rates and no dividends. TSAL 1-year forward price is quoted at $450, and 1-year TSLA call

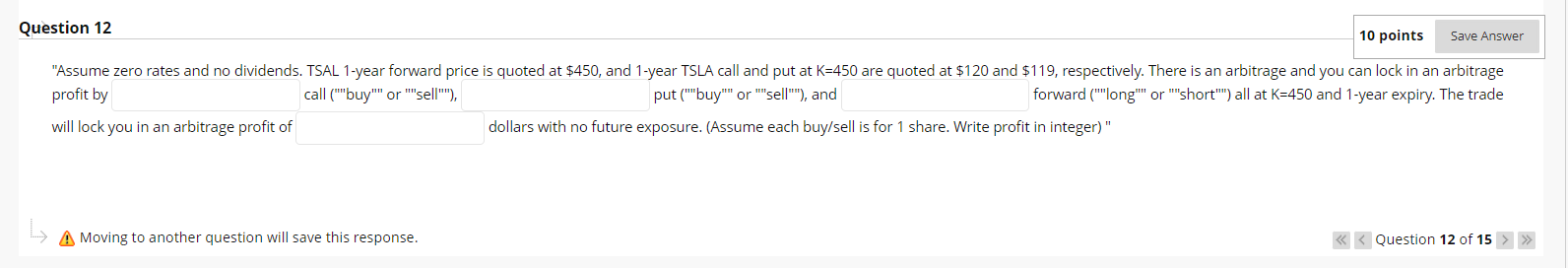

Question 12 10 points Save Answer "Assume zero rates and no dividends. TSAL 1-year forward price is quoted at $450, and 1-year TSLA call and put at K=450 are quoted at $120 and $119, respectively. There is an arbitrage and you can lock in an arbitrage profit by call ("buy" or "sell""), put("buy" or "sell"""), and forward ("""long"" or "short") all at K=450 and 1-year expiry. The trade dollars with no future exposure. (Assume each buy/sell is for 1 share. Write profit in integer)" will lock you in an arbitrage profit of A Moving to another question will save this response. < < < Question 12 of 15

Step by Step Solution

There are 3 Steps involved in it

To solve this arbitrage opportunity we can use the concept of putcall parity which states C P F 0 K ... View full answer

Get step-by-step solutions from verified subject matter experts