Question: QUESTION 12 10 points Save Answer Can you grow a dividend when growth is not constant? Firm Tomorrowland paid a dividend last quarter of $6.98.

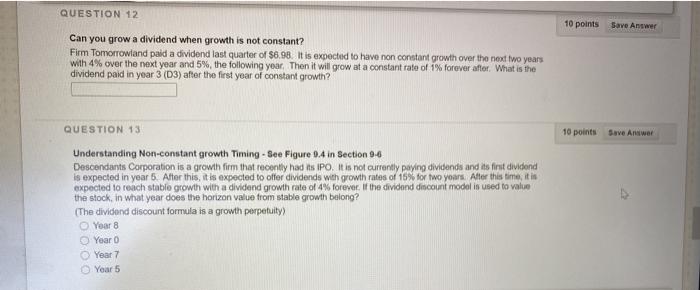

QUESTION 12 10 points Save Answer Can you grow a dividend when growth is not constant? Firm Tomorrowland paid a dividend last quarter of $6.98. It is expected to have non constant growth over the next two years with 4% over the next year and 5%, the following year. Then it will grow at a constant rate of 1% forever after. What is the dividend paid in year 3 (D3) after the first year of constant growth? QUESTION 13 10 points Save Answer Understanding Non-constant growth Timing - See Figure 0.4 in Section 9-6 Descendants Corporation is a growth firm that recently had its IPO. It is not currently paying dividends and its first dividend is expected in year 5. After this, it is expected to offer dividends with growth rates of 15% for two years. After this time, it is expected to reach stable growth with a dividend growth rate of 4% forever. If the dividend discount model is used to value the stock, in what year does the horizon value from stable growth belong? (The dividend discount formula is a growth perpetuity) Year 8 Year Year 7 Year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts