Question: Question 12 10 points Save Answer You are constructing a portfolio of two assets, Asset A and Asset B. The expected returns of the

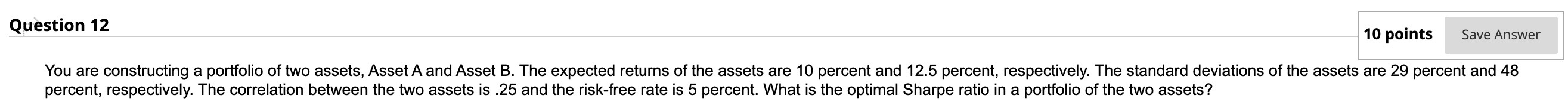

Question 12 10 points Save Answer You are constructing a portfolio of two assets, Asset A and Asset B. The expected returns of the assets are 10 percent and 12.5 percent, respectively. The standard deviations of the assets are 29 percent and 48 percent, respectively. The correlation between the two assets is .25 and the risk-free rate is 5 percent. What is the optimal Sharpe ratio in a portfolio of the two assets?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts