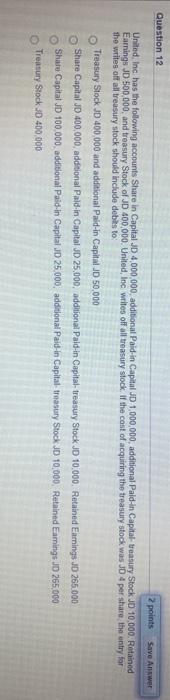

Question: Question 12 2 points Save Answer United, Inc has the following accounts Share in Capital JD 4,000,000, additional Paid-in Capital JD 1,000,000. additional Pald-in Capital

Question 12 2 points Save Answer United, Inc has the following accounts Share in Capital JD 4,000,000, additional Paid-in Capital JD 1,000,000. additional Pald-in Capital treasury Stock JD 10,000. Retained Earnings JD 500.000, and treasury Stock of JD 400.000. United, Inc writes off all treasury stock. If the cost of acquiring the treasury stock was JO 4 per share the entry for the writes off all treasury stock should include debits to Treasury Stock JD 400,000 and additional Paid-in Capital JD 50,000 Share Capital JD 400,000, additional Paild-in Capital JD 25.000, additional Paid-in Capital-treasury Stock JD 10,000, Retained Earnings JD 265.000 Share Capital JD 100,000, additional Paic-in Capital JD 25,000, additional Paid-in Capital treasury Stock JD 10,000, Retained Earings HD 265,000 Treasury Stock JD 400.000 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts