Question: Question 12 3 pts The efficient frontier Represents the subset of dominated portfolios O Represents all investable portfolios Represents the combination of portfolios with correlation

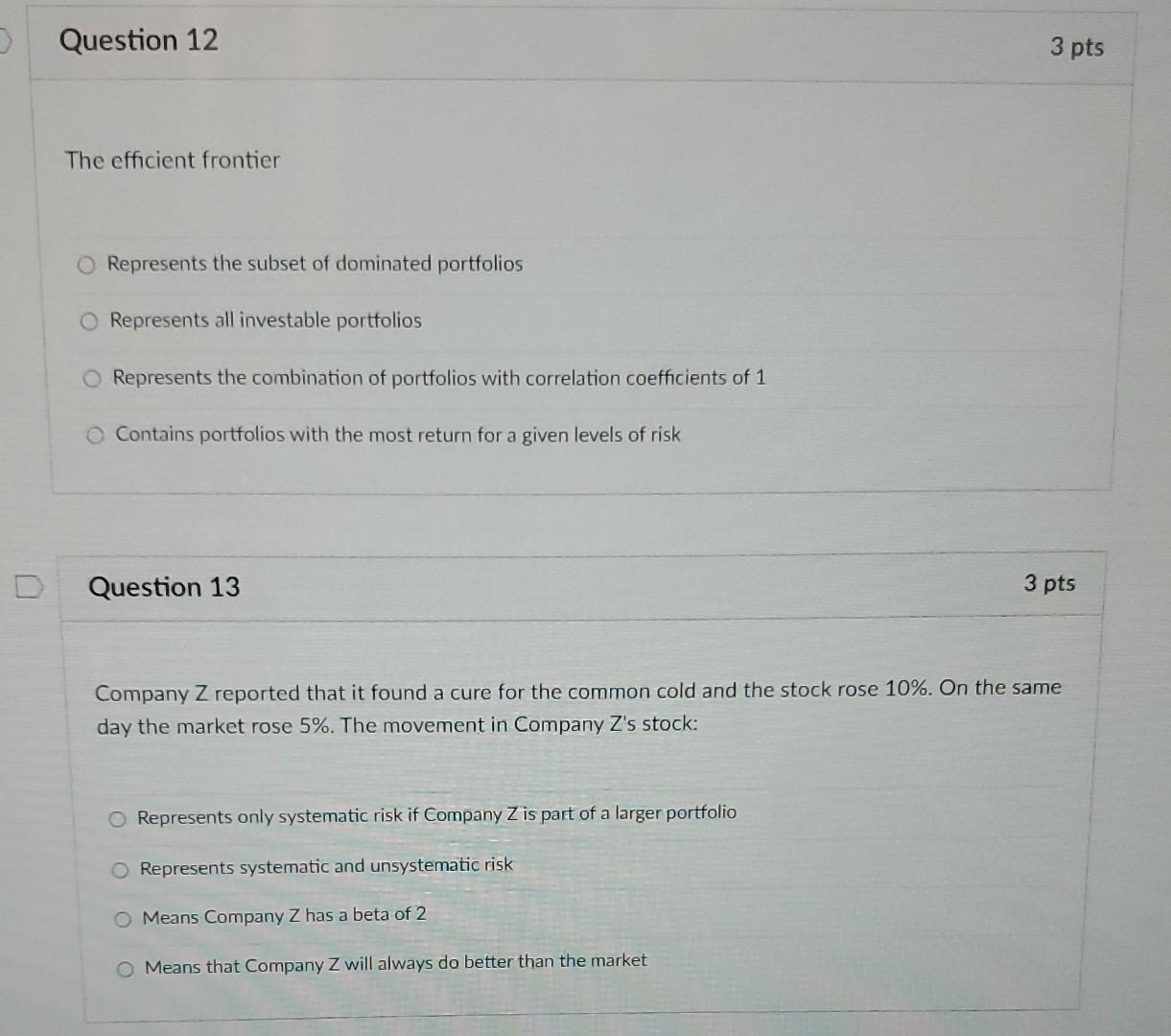

Question 12 3 pts The efficient frontier Represents the subset of dominated portfolios O Represents all investable portfolios Represents the combination of portfolios with correlation coefficients of 1 O Contains portfolios with the most return for a given levels of risk Question 13 3 pts Company Z reported that it found a cure for the common cold and the stock rose 10%. On the same day the market rose 5%. The movement in Company Z's stock: O Represents only systematic risk if Company Z is part of a larger portfolio Represents systematic and unsystematic risk O Means Company Z has a beta of 2 O Means that Company Z will always do better than the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts