Question: Question 12 3.4 points Save Answer Kimble Co. had in 2021 taxable income of $150 million before applying any net operating loss carryforward from previous

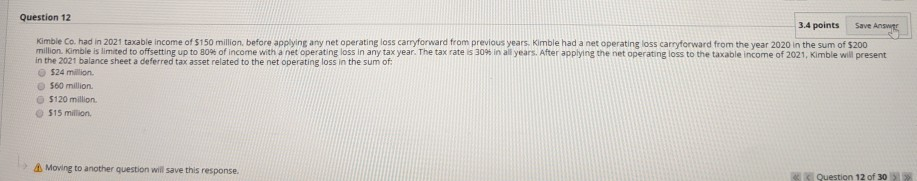

Question 12 3.4 points Save Answer Kimble Co. had in 2021 taxable income of $150 million before applying any net operating loss carryforward from previous years. Kimble had a net operating loss carryforward from the year 2020 in the sum of $200 million, Kimble is limited to offsetting up to 80% of income with a net operating loss in any tax year. The tax rate is 30% in all years. After applying the net operating loss to the taxable income of 2021, Kimble will present in the 2021 balance sheet a deferred tax asset related to the net operating loss in the sum of: $24 million 560 million $120 million 515 million Moving to another question will save this response. Question 12 of 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts