Question: Question 12 5 pts A put option with a strike price of $1.25 and a premium of $0.10 will have a floor at what amount?

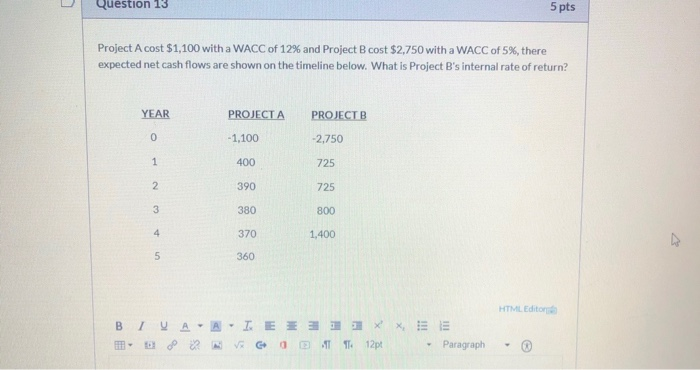

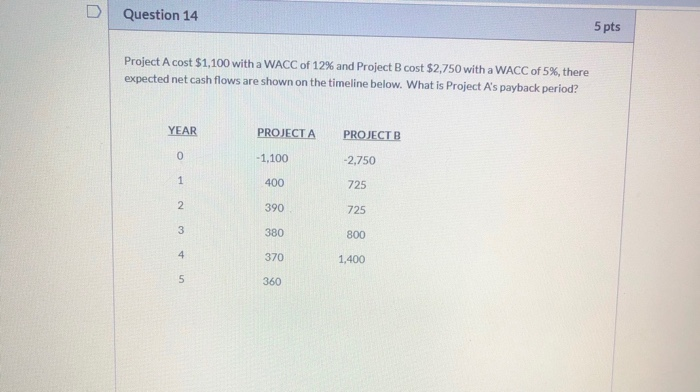

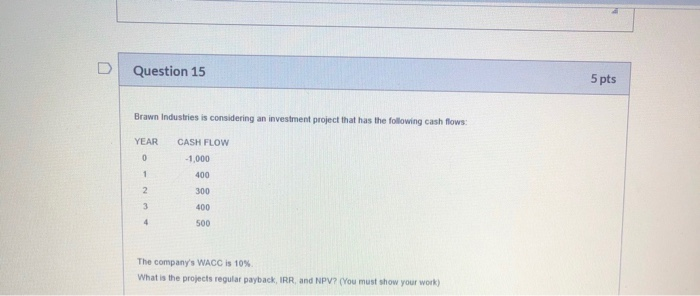

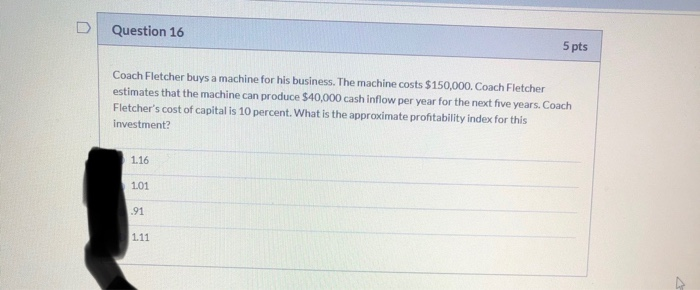

Question 12 5 pts A put option with a strike price of $1.25 and a premium of $0.10 will have a floor at what amount? You must show your work. HTML Editor BIVA-AIE E 3 13 X X EE - - Question 13 5 pts Project A cost $1,100 with a WACC of 12% and Project B cost $2,750 with a WACC of 5%, there expected net cash flows are shown on the timeline below. What is Project B's internal rate of return? YEAR PROJECT A PROJECTB -2,750 -1,100 400 725 725 1,400 HTML Editora BIVA-A- IEE311x X, EE DO V E GODT 114 12pt - Paragraph - Question 14 5 pts Project A cost $1,100 with a WACC of 12% and Project B cost $2,750 with a WACC of 5%, there expected net cash flows are shown on the timeline below. What is Project A's payback period? YEAR PROJECT A PROJECTB -1,100 -2.750 400 725 725 800 1,400 Question 15 5 pts Brawn Industries is considering an investment project that has the following cash flows: YEAR CASH FLOW -1,000 400 300 400 500 The company's WACC is 10% What is the projects regular payback, IRR and NPV? (You must show your work) Question 16 5 pts Coach Fletcher buys a machine for his business. The machine costs $150,000. Coach Fletcher estimates that the machine can produce $40,000 cash inflow per year for the next five years. Coach Fletcher's cost of capital is 10 percent. What is the approximate profitability index for this investment? 1.16 Question 12 5 pts A put option with a strike price of $1.25 and a premium of $0.10 will have a floor at what amount? You must show your work. HTML Editor BIVA-AIE E 3 13 X X EE - - Question 13 5 pts Project A cost $1,100 with a WACC of 12% and Project B cost $2,750 with a WACC of 5%, there expected net cash flows are shown on the timeline below. What is Project B's internal rate of return? YEAR PROJECT A PROJECTB -2,750 -1,100 400 725 725 1,400 HTML Editora BIVA-A- IEE311x X, EE DO V E GODT 114 12pt - Paragraph - Question 14 5 pts Project A cost $1,100 with a WACC of 12% and Project B cost $2,750 with a WACC of 5%, there expected net cash flows are shown on the timeline below. What is Project A's payback period? YEAR PROJECT A PROJECTB -1,100 -2.750 400 725 725 800 1,400 Question 15 5 pts Brawn Industries is considering an investment project that has the following cash flows: YEAR CASH FLOW -1,000 400 300 400 500 The company's WACC is 10% What is the projects regular payback, IRR and NPV? (You must show your work) Question 16 5 pts Coach Fletcher buys a machine for his business. The machine costs $150,000. Coach Fletcher estimates that the machine can produce $40,000 cash inflow per year for the next five years. Coach Fletcher's cost of capital is 10 percent. What is the approximate profitability index for this investment? 1.16