Question: QUESTION 12 A MPT is being issued backed by a mortgage pool that consists of 100 mortgages with an average balance of 150,000. Mortgages are

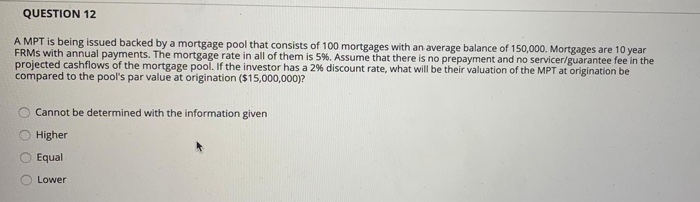

QUESTION 12 A MPT is being issued backed by a mortgage pool that consists of 100 mortgages with an average balance of 150,000. Mortgages are 10 year FRMs with annual payments. The mortgage rate in all of them is 5%. Assume that there is no prepayment and no servicer/guarantee fee in the projected cashflows of the mortgage pool. If the investor has a 2% discount rate, what will be their valuation of the MPT at origination be compared to the pool's par value at origination ($15,000,000)? Cannot be determined with the information given Higher Equal Lower

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock