Question: Question 12: a. Old Air inc. has been operating for several years. Its market determined beta is 2.0, its market capitaf structure is 80 percent

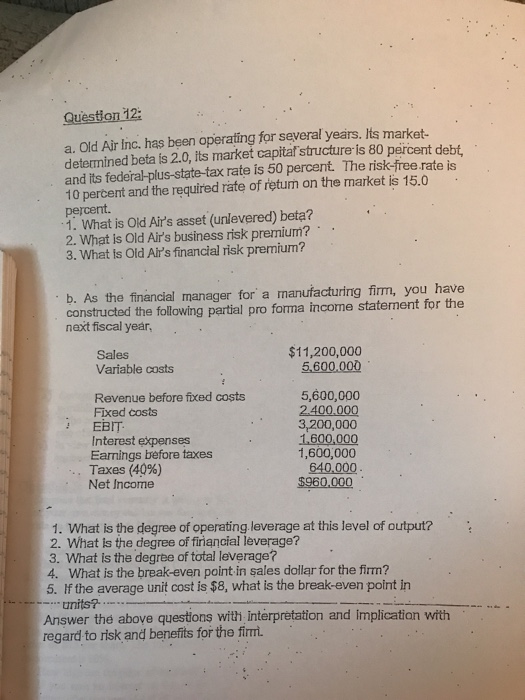

Question 12: a. Old Air inc. has been operating for several years. Its market determined beta is 2.0, its market capitaf structure is 80 percent debt and its federal-plus-state-tax rate is 50 percent. The riskfree.rate is 10 percent and the required rate of retum on the market is 15.0 percent. 1. What is Old Air's asset (unlevered) beta? 2. What is Old Air's business risk premium? 3. What is Old Air's financial risk premium? b. As the financial manager for a manufacturing firm, you have constructed the following partial pro forma income staternen t for the next fiscal year, $11,200,000 5,600.000 Sales Variable costs Revenue before fixed costs Fixed costs EBIT Interest expenses Earnings before taxes 5,600,000 2.400.000 3,200,000 1600,000 1,600,000 640,000 $960,000 .. Taxes (40%) Net Income 1. What is the degree of operating leverage at this level of output? 2. What is the degree of firiancial leverage? 3. What is the degree of total leverage? 4. What is the break-even point in sales dollar for the firm? 5. If the average unit cost is $8, what is the break-even point in units7 Answer the above questions with interpretation and Implication with regard to risk and benefits for the fii

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts