Question: QUESTION 12: a) What is the difference between pledging accounts receivable to secure loan and factoring accounts receivable? (5 marks) b) Consider a six-year lease

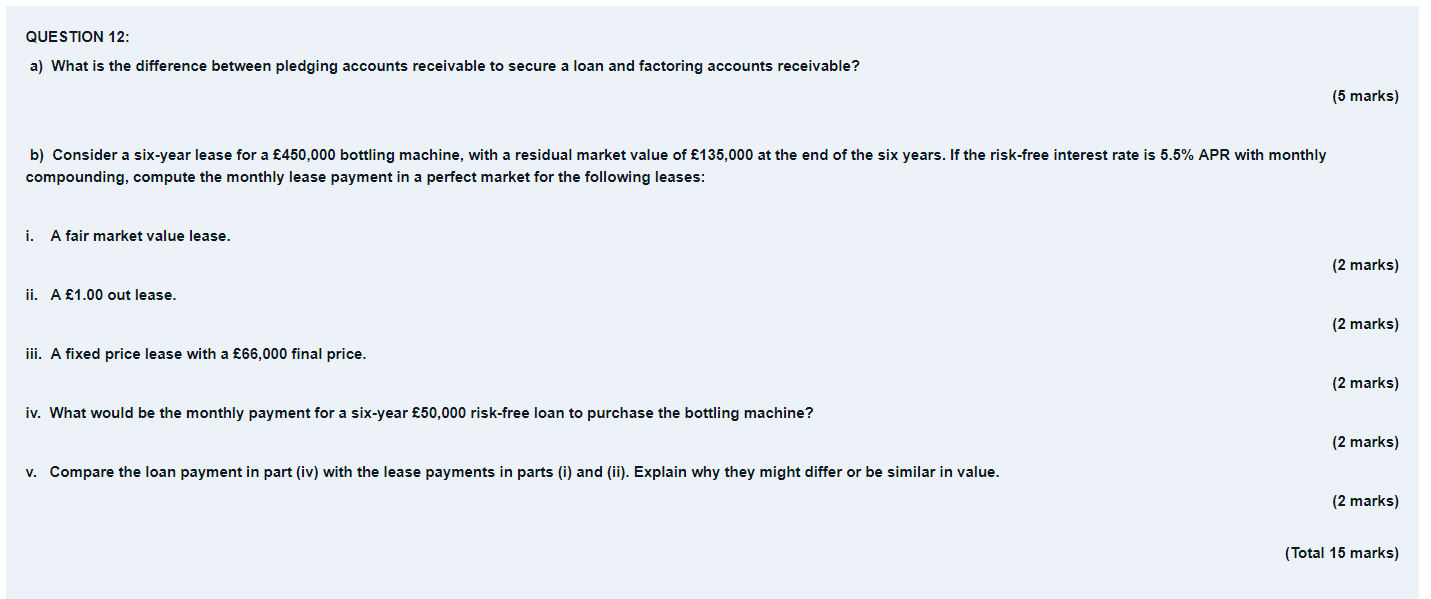

QUESTION 12: a) What is the difference between pledging accounts receivable to secure loan and factoring accounts receivable? (5 marks) b) Consider a six-year lease for a 450,000 bottling machine, with a residual market value of 135,000 at the end of the six years. If the risk-free interest rate is 5.5% APR with monthly compounding, compute the monthly lease payment in a perfect market for the following leases: i. A fair market value lease. (2 marks) ii. A 1.00 out lease. (2 marks) iii. A fixed price lease with a 66,000 final price. (2 marks) iv. What would be the monthly payment for a six-year 50,000 risk-free loan to purchase the bottling machine? (2 marks) V. Compare the loan payment in part (iv) with the lease payments in parts (i) and (ii). Explain why they might differ or similar in value. (2 marks) (Total 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts