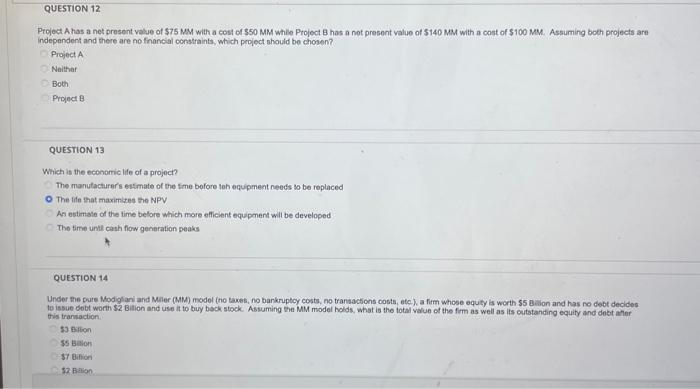

Question: question 12 and question 14 please! Project A has a net presont value of $75MM with a cost of $50 MM whlle Project B has

Project A has a net presont value of $75MM with a cost of $50 MM whlle Project B has a not presont valuo of 5140 MM with a cost of $100 MM. Assuming both projects are independent and there are no finaneial constraints, which peoject ahould be chosen? Project A Neithar Both Project B QUESTION 13 Which is the economic Iffe of a projoct? The manutacturar's esimate of the time bofore toh equipment needs to be roplaced The ife that maximites the NPV An estmale of the time belore which more efficient equpment will be developed Tho time untl cash fw generation peaks QUESTION 14 Under the pure Modigfani and Maler (MM) model (no taxes, no barkruptcy costs, no transactions costs, etc), a fitm whose equty is worth 55 Baion and has no debt decides to issue debt worth $2 Bition and use it to biy beck stock. Assuming the MM model holds, what is the total value of the fim as well as its cutstanding equity and dobt aler this trankaction. 23 Eiftion 15 baton \$7 Bifion 12 Bation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts