Question: QUESTION 12 low. Consider a sequential trade model in which a security has an uncertain value. The value V of the security can either be

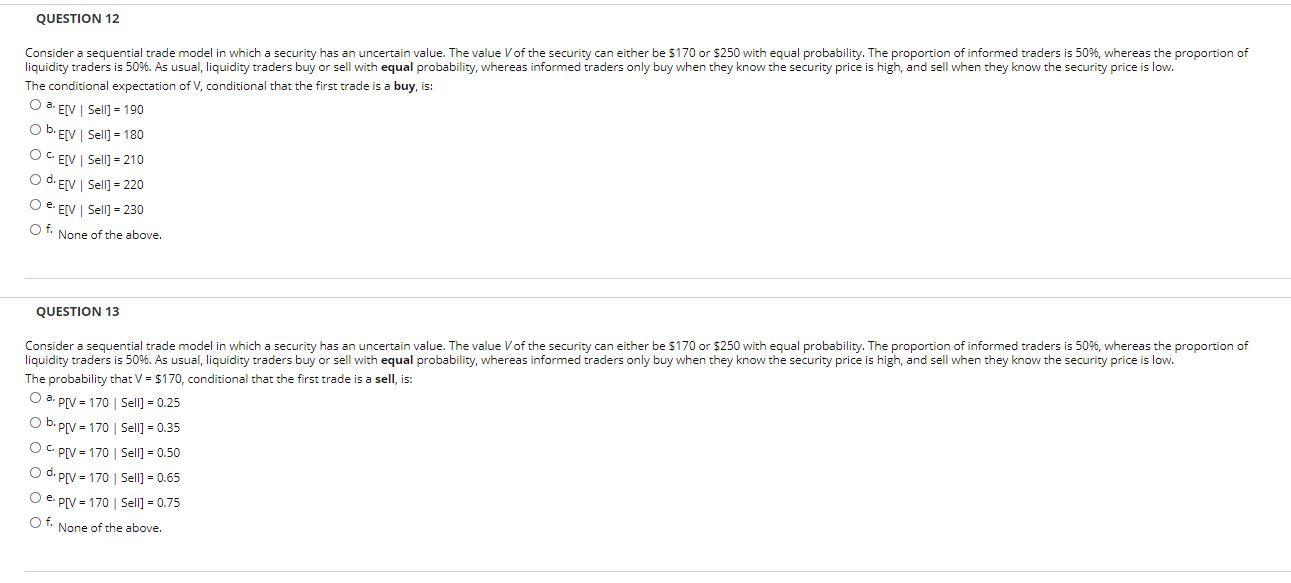

QUESTION 12 low. Consider a sequential trade model in which a security has an uncertain value. The value V of the security can either be $170 or $250 with equal probability. The proportion of informed traders is 50%, whereas the proportion of liquidity traders is 50%. As usual, liquidity traders buy or sell with equal probability, whereas informed traders only buy when they know the security price is high, and sell when they know the security price The conditional expectation of V, conditional that the first trade is a buy, is: a.E[V Sell] = 190 b. EIV Sell] = 180 O E[V Sell] = 210 d. ELV | Sell] = 220 O e EV | Sell] = 230 Of. None of the above. QUESTION 13 Consider a sequential trade model in which a security has an uncertain value. The value V of the security can either be $170 or $250 with equal probability. The proportion of informed traders is 50%, whereas the proportion of liquidity traders is 50%. As usual, liquidity traders buy or sell with equal probability, whereas informed traders only buy when they know the security price is high, and sell when they know the security price is low. The probability that V = $170, conditional that the first trade is a sell, is: O a. P[V = 170 Sell] = 0.25 b. P[V = 170 Sell] = 0.35 OP[V = 170 Sell] = 0.50 d. P[V = 170 | Sell] = 0.65 O e P[V = 170 Sell] = 0.75 Of. None of the above. QUESTION 12 low. Consider a sequential trade model in which a security has an uncertain value. The value V of the security can either be $170 or $250 with equal probability. The proportion of informed traders is 50%, whereas the proportion of liquidity traders is 50%. As usual, liquidity traders buy or sell with equal probability, whereas informed traders only buy when they know the security price is high, and sell when they know the security price The conditional expectation of V, conditional that the first trade is a buy, is: a.E[V Sell] = 190 b. EIV Sell] = 180 O E[V Sell] = 210 d. ELV | Sell] = 220 O e EV | Sell] = 230 Of. None of the above. QUESTION 13 Consider a sequential trade model in which a security has an uncertain value. The value V of the security can either be $170 or $250 with equal probability. The proportion of informed traders is 50%, whereas the proportion of liquidity traders is 50%. As usual, liquidity traders buy or sell with equal probability, whereas informed traders only buy when they know the security price is high, and sell when they know the security price is low. The probability that V = $170, conditional that the first trade is a sell, is: O a. P[V = 170 Sell] = 0.25 b. P[V = 170 Sell] = 0.35 OP[V = 170 Sell] = 0.50 d. P[V = 170 | Sell] = 0.65 O e P[V = 170 Sell] = 0.75 Of. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts