Question: Question 12 Mapple Corp is considering a project that will cost $20 million initial investment. The company projects to have payoffs of $5 mil, $8

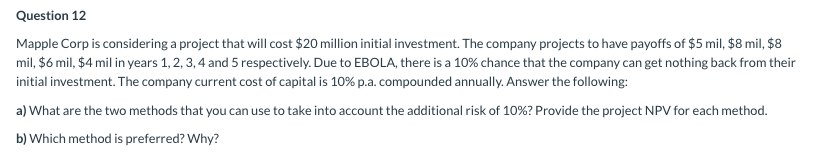

Question 12 Mapple Corp is considering a project that will cost $20 million initial investment. The company projects to have payoffs of $5 mil, $8 mil, $8 mil, $6 mil, $4 mil in years 1, 2, 3, 4 and 5 respectively. Due to EBOLA, there is a 10% chance that the company can get nothing back from their initial investment. The company current cost of capital is 10% p.a. compounded annually. Answer the following: a) What are the two methods that you can use to take into account the additional risk of 10%? Provide the project NPV for each method. b) Which method is preferred? Why? Question 12 Mapple Corp is considering a project that will cost $20 million initial investment. The company projects to have payoffs of $5 mil, $8 mil, $8 mil, $6 mil, $4 mil in years 1, 2, 3, 4 and 5 respectively. Due to EBOLA, there is a 10% chance that the company can get nothing back from their initial investment. The company current cost of capital is 10% p.a. compounded annually. Answer the following: a) What are the two methods that you can use to take into account the additional risk of 10%? Provide the project NPV for each method. b) Which method is preferred? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts