Question: QUESTION 12 NOTE: this question is 20 points so be sure to try to answer as many parts as you can for partial credit If

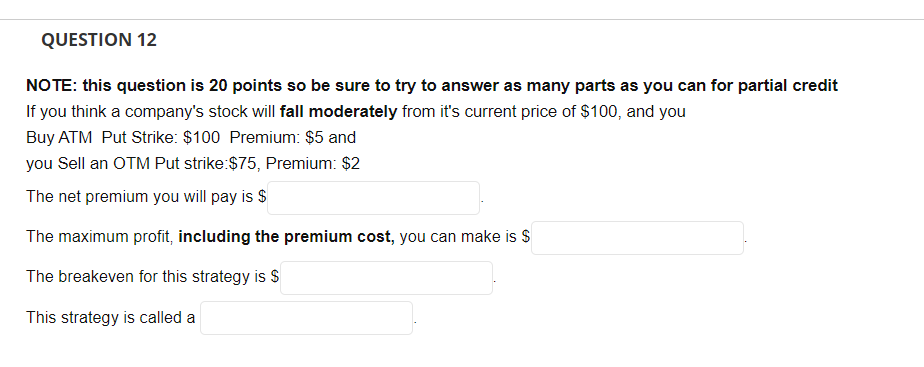

QUESTION 12 NOTE: this question is 20 points so be sure to try to answer as many parts as you can for partial credit If you think a company's stock will fall moderately from it's current price of $100, and you Buy ATM Put Strike: $100 Premium: $5 and you Sell an OTM Put strike:$75, Premium: $2 The net premium you will pay is $ The maximum profit, including the premium cost, you can make is $ The breakeven for this strategy is $ This strategy is called a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts