Question: Question 12, please. Question 12 is completely provided already. ! Incorrect First calculate the values of V at the end nodes by using u and

Question 12, please.

Question 12 is completely provided already.

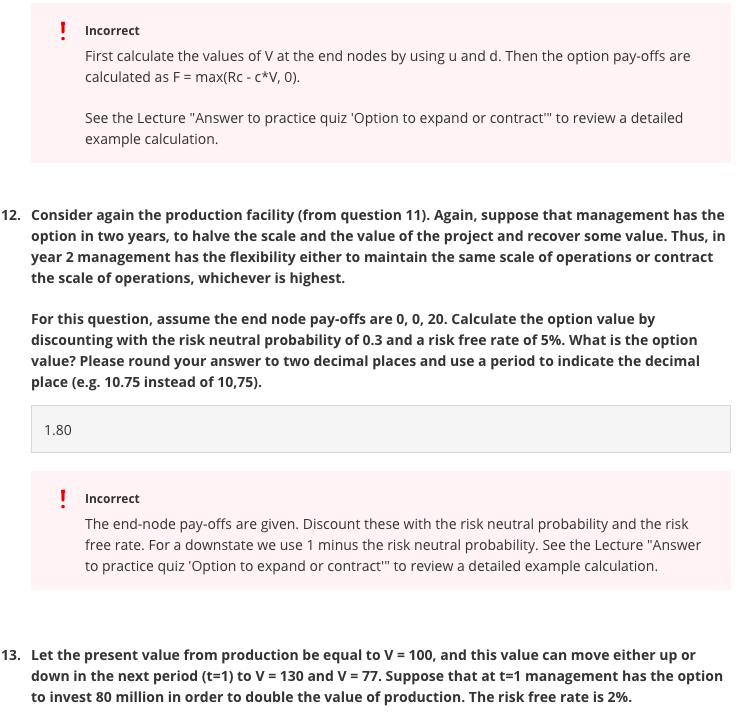

! Incorrect First calculate the values of V at the end nodes by using u and d. Then the option pay-offs are calculated as F = max(Rc - c*V, 0). See the Lecture "Answer to practice quiz 'Option to expand or contract" to review a detailed example calculation. 12. Consider again the production facility (from question 11). Again, suppose that management has the option in two years, to halve the scale and the value of the project and recover some value. Thus, in year 2 management has the flexibility either to maintain the same scale of operations or contract the scale of operations, whichever is highest. For this question, assume the end node pay-offs are 0, 0, 20. Calculate the option value by discounting with the risk neutral probability of 0.3 and a risk free rate of 5%. What is the option value? Please round your answer to two decimal places and use a period to indicate the decimal place (e.g. 10.75 instead of 10,75). 1.80 ! Incorrect The end-node pay-offs are given. Discount these with the risk neutral probability and the risk free rate. For a downstate we use 1 minus the risk neutral probability. See the Lecture "Answer to practice quiz 'Option to expand or contract" to review a detailed example calculation. 13. Let the present value from production be equal to V = 100, and this value can move either up or down in the next period (t=1) to V = 130 and V = 77. Suppose that at t=1 management has the option to invest 80 million in order to double the value of production. The risk free rate is 2%. ! Incorrect First calculate the values of V at the end nodes by using u and d. Then the option pay-offs are calculated as F = max(Rc - c*V, 0). See the Lecture "Answer to practice quiz 'Option to expand or contract" to review a detailed example calculation. 12. Consider again the production facility (from question 11). Again, suppose that management has the option in two years, to halve the scale and the value of the project and recover some value. Thus, in year 2 management has the flexibility either to maintain the same scale of operations or contract the scale of operations, whichever is highest. For this question, assume the end node pay-offs are 0, 0, 20. Calculate the option value by discounting with the risk neutral probability of 0.3 and a risk free rate of 5%. What is the option value? Please round your answer to two decimal places and use a period to indicate the decimal place (e.g. 10.75 instead of 10,75). 1.80 ! Incorrect The end-node pay-offs are given. Discount these with the risk neutral probability and the risk free rate. For a downstate we use 1 minus the risk neutral probability. See the Lecture "Answer to practice quiz 'Option to expand or contract" to review a detailed example calculation. 13. Let the present value from production be equal to V = 100, and this value can move either up or down in the next period (t=1) to V = 130 and V = 77. Suppose that at t=1 management has the option to invest 80 million in order to double the value of production. The risk free rate is 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts