Question: Question 12 Question123: 4.. 3. Two competing project proposals, 1 and 2, are currently under consideration for the manufacture of a new product line. Information

Question 12

Question123:

4..

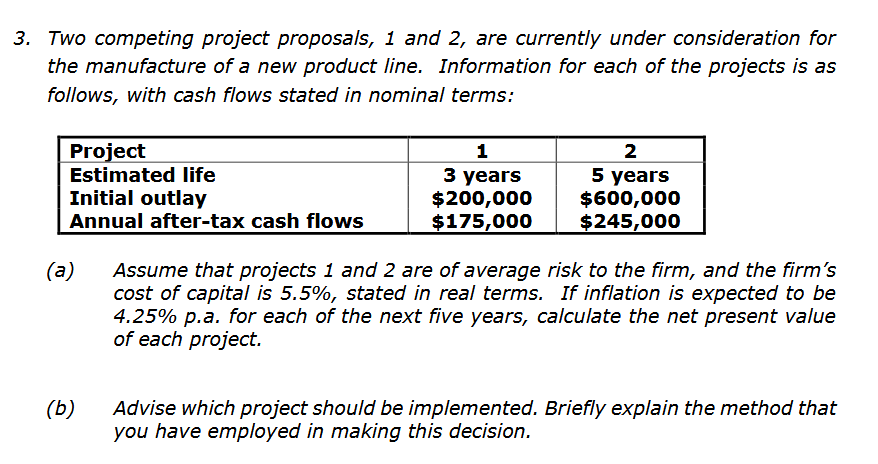

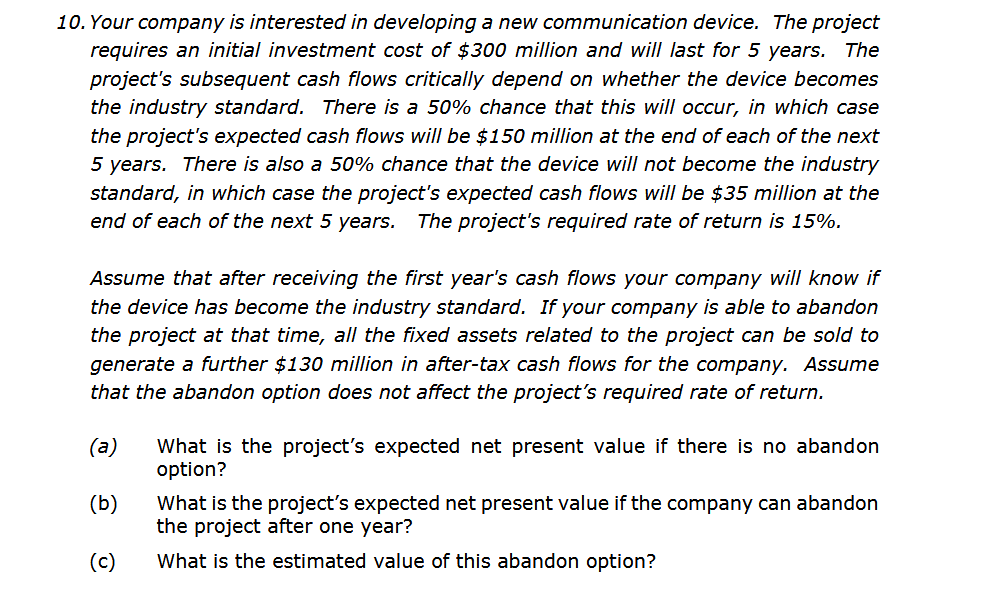

3. Two competing project proposals, 1 and 2, are currently under consideration for the manufacture of a new product line. Information for each of the projects is as follows, with cash flows stated in nominal terms: Project Estimated life Initial outlay Annual after-tax cash flows 1 3 years $200,000 $175,000 2 5 years $600,000 $245,000 (a) Assume that projects 1 and 2 are of average risk to the firm, and the firm's cost of capital is 5.5%, stated in real terms. If inflation is expected to be 4.25% p.a. for each of the next five years, calculate the net present value of each project. (b) Advise which project should be implemented. Briefly explain the method that you have employed in making this decision. 10. Your company is interested in developing a new communication device. The project requires an initial investment cost of $300 million and will last for 5 years. The project's subsequent cash flows critically depend on whether the device becomes the industry standard. There is a 50% chance that this will occur, in which case the project's expected cash flows will be $150 million at the end of each of the next 5 years. There is also a 50% chance that the device will not become the industry standard, in which case the project's expected cash flows will be $35 million at the end of each of the next 5 years. The project's required rate of return is 15%. Assume that after receiving the first year's cash flows your company will know the device has become the industry standard. If your company is able to abandon the project at that time, all the fixed assets related to the project can be sold to generate a further $130 million in after-tax cash flows for the company. Assume that the abandon option does not affect the project's required rate of return. (a) (b) What is the project's expected net present value if there is no abandon option? What is the project's expected net present value if the company can abandon the project after one year? What is the estimated value of this abandon option? (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts