Question: QUESTION 12 Save Answer 8 points a. Assume you (an Australian citizen) own 25,000 shares in Reliance Corp that operates in the dividend imputation

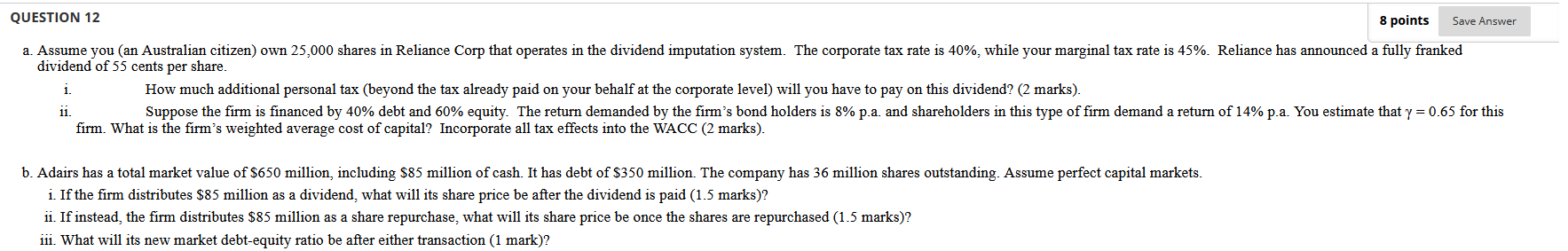

QUESTION 12 Save Answer 8 points a. Assume you (an Australian citizen) own 25,000 shares in Reliance Corp that operates in the dividend imputation system. The corporate tax rate is 40%, while your marginal tax rate is 45%. Reliance has announced a fully franked dividend of 55 cents per share. i. ii. How much additional personal tax (beyond the tax already paid on your behalf at the corporate level) will you have to pay on this dividend? (2 marks). Suppose the firm is financed by 40% debt and 60% equity. The return demanded by the firm's bond holders is 8% p.a. and shareholders in this type of firm demand a return of 14% p.a. You estimate that y = 0.65 for this firm. What is the firm's weighted average cost of capital? Incorporate all tax effects into the WACC (2 marks). b. Adairs has a total market value of $650 million, including $85 million of cash. It has debt of $350 million. The company has 36 million shares outstanding. Assume perfect capital markets. i. If the firm distributes $85 million as a dividend, what will its share price be after the dividend is paid (1.5 marks)? ii. If instead, the firm distributes $85 million as a share repurchase, what will its share price be once the shares are repurchased (1.5 marks)? iii. What will its new market debt-equity ratio be after either transaction (1 mark)?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts