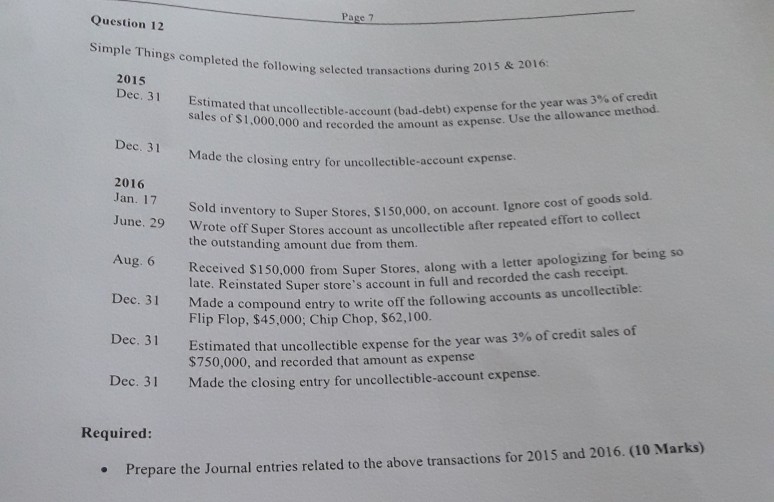

Question: Question 12 Simple Things completed the following selected transacti during 2015 & 2016: 2015 Dec. 31 Estimated that un he year was 3% of credit

Question 12 Simple Things completed the following selected transacti during 2015 & 2016: 2015 Dec. 31 Estimated that un he year was 3% of credit collectible-account (bad-debt) expense for t 0 and recorded the amount as expense. Use the allowance method. Dec. 31 Made the closing etn ade the closing entry for uncollectible-account expense. 2016 inventory to Super Stores, s150,000, on account. Ignore cost of goods sold. oft Super Stores account as uncollectible after repeated effort to collect June. 29 the outstanding amount due from them. eceived S150,000 from Super Stores, along with a letter apologizing for being so late. Reinstated Super store's account Aug. 6 in full and recorded the cash receipt. e a compound entry to write off the following accounts as uncollectible: Flip Flop, $45,000, Chip Chop, $62,100. Estimated that uncollectible expense for the year was 3% ofcredit sales of $750,000, and recorded that amount as expense Dec. 31 Dec. 31 Made the closing entry for uncollectible-account expense. Required: Prepare the Journal entries related to the above transactions for 2015 and 2016. (10 Marks) e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts