Question: Question 12 The Capital Budgeting method called the discounted payback period (DPP) is better than the ordinary payback (PP) period because The DPP does not

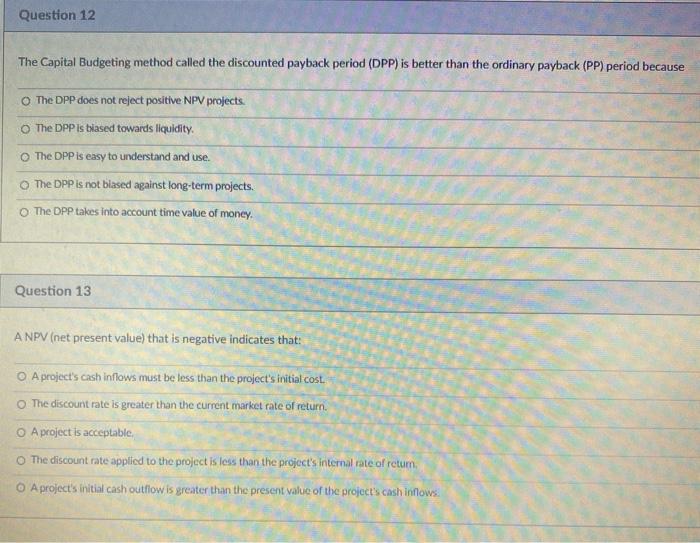

Question 12 The Capital Budgeting method called the discounted payback period (DPP) is better than the ordinary payback (PP) period because The DPP does not reject positive NPV projects. The DPP is trased towards liquidity. The DPP is easy to understand and use. The DPP is not biased against long-term projects. The DPP takes into account time value of money. Question 13 A NPV (net present value) that is negative indicates that: o A project's cash inflows must be less than the project's initial cost. The discount rate is greater than the current market rate of return. A project is acceptable, The discount rate applied to the project is less than the project's internal rate of retum A projects initial cash outflow is greater than the present value of the project's cash inflows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts