Question: QUESTION 12 Under what circumstances, in setting up our Markowitz portfolio optimization, would we want u and to differ from their historical estimates? Use

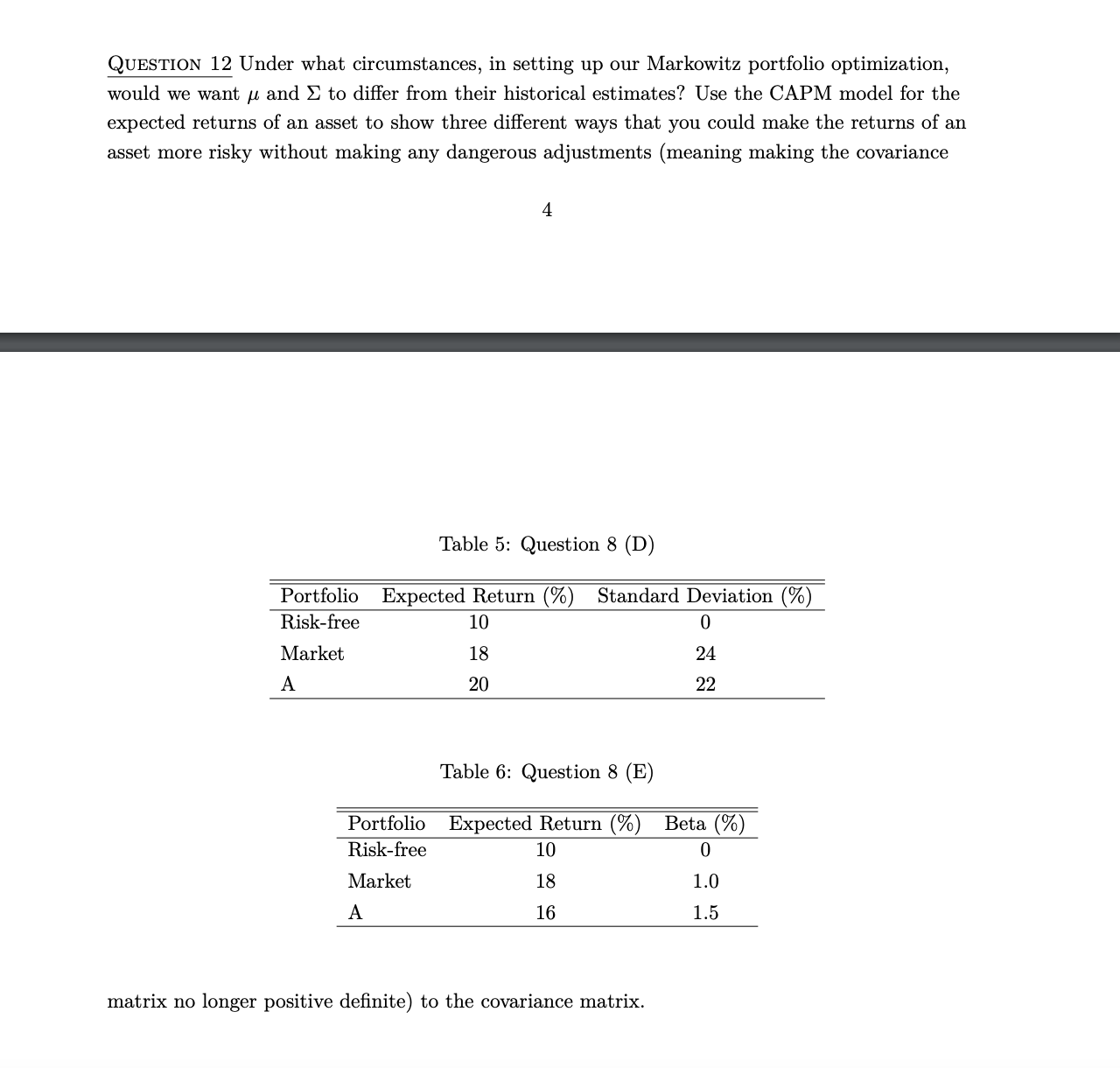

QUESTION 12 Under what circumstances, in setting up our Markowitz portfolio optimization, would we want u and to differ from their historical estimates? Use the CAPM model for the expected returns of an asset to show three different ways that you could make the returns of an asset more risky without making any dangerous adjustments (meaning making the covariance 4 Table 5: Question 8 (D) Portfolio Expected Return (%) Standard Deviation (%) Risk-free 10 0 Market 18 24 A 20 22 Table 6: Question 8 (E) Portfolio Expected Return (%) Risk-free Market A 10 18 16 matrix no longer positive definite) to the covariance matrix. Beta (%) 0 1.0 1.5

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

There are situations in which we may want to modify the historical estimates of anticipated returns and covariance matrix when configuring a Markowitz portfolio optimization These modifications may be ... View full answer

Get step-by-step solutions from verified subject matter experts