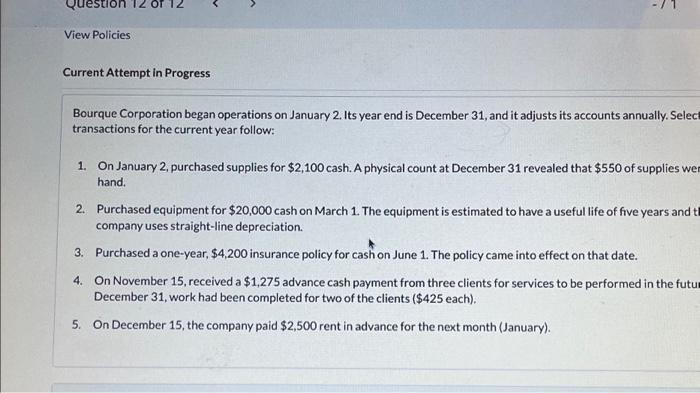

Question: Question 12 View Policies Current Attempt in Progress Bourque Corporation began operations on January 2. Its year end is December 31, and it adjusts its

Bourque Corporation began operations on January 2 . Its year end is December 31, and it adjusts its accounts annually. Sele transactions for the current year follow: 1. On January 2, purchased supplies for $2,100 cash. A physical count at December 31 revealed that $550 of supplies we hand. 2. Purchased equipment for $20,000 cash on March 1. The equipment is estimated to have a useful life of five years and company uses straight-line depreciation. 3. Purchased a one-year, $4,200 insurance policy for cash on June 1. The policy came into effect on that date. 4. On November 15 , received a $1,275 advance cash payment from three clients for services to be performed in the futs December 31, work had been completed for two of the clients ( $425 each). 5. On December 15 , the company paid $2,500 rent in advance for the next month (January)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts