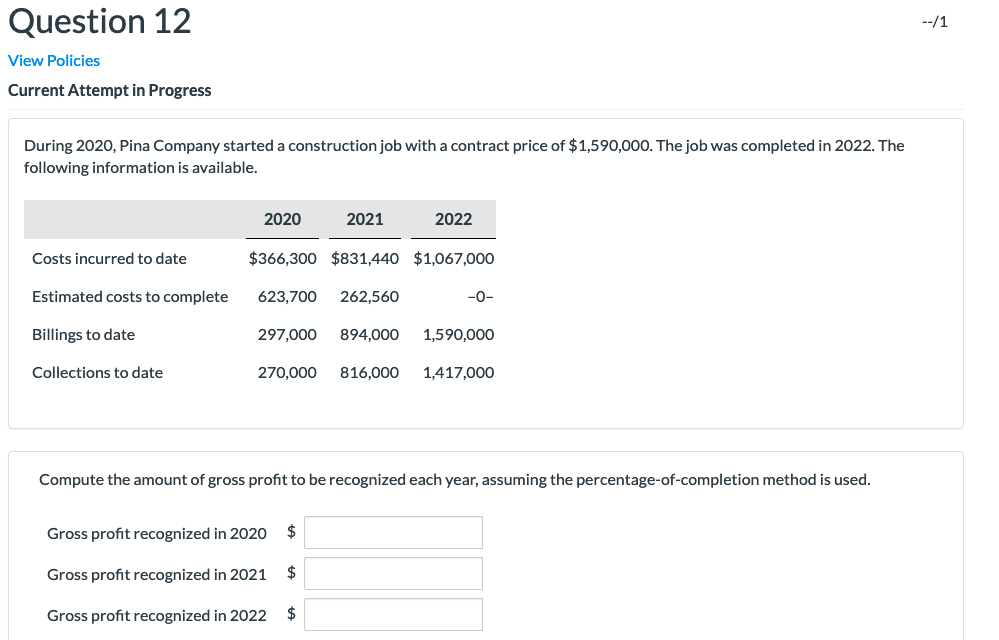

Question: Question 12 View Policies Current Attempt in Progress During 2020, Pina Company started a construction job with a contract price of $1,590,000. The job was

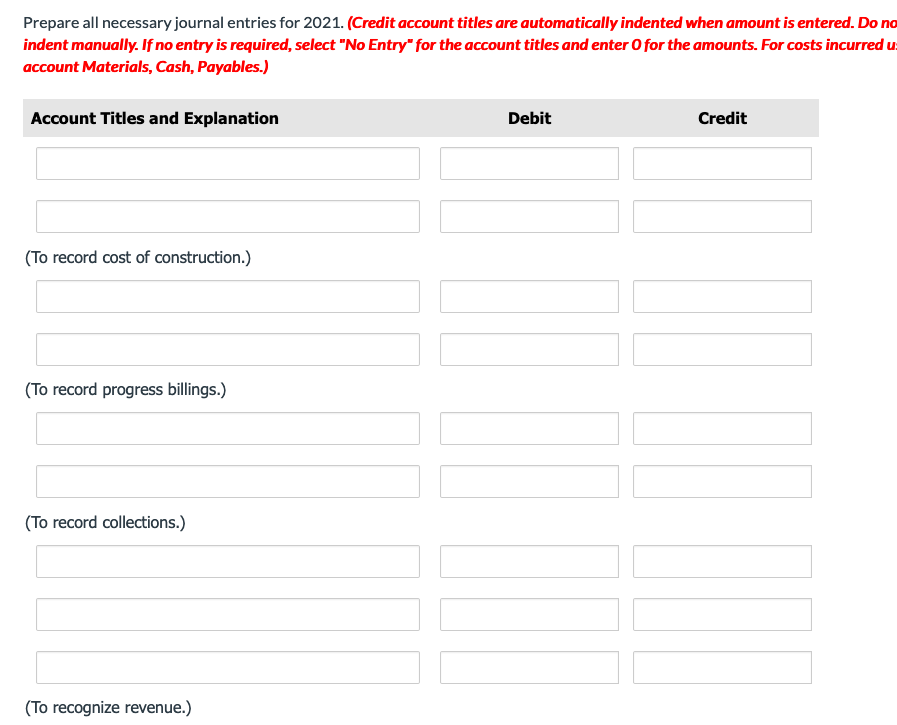

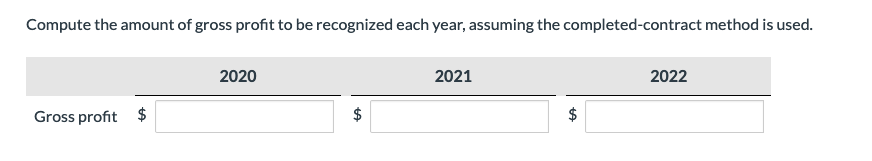

Question 12 View Policies Current Attempt in Progress During 2020, Pina Company started a construction job with a contract price of $1,590,000. The job was completed in 2022. The following information is available. 2020 2021 2022 Costs incurred to date Estimated costs to complete 623,700 262,560 -0- Billings to date 297,000 270,000 894,000 816,000 1,590,000 1,417,000 Collections to date Compute the amount of gross profit to be recognized each year, assuming the percentage-of-completion method is used. Gross profit recognized in 2020 $ Gross profit recognized in 2021 $ Gross profit recognized in 2022 $ Prepare all necessary journal entries for 2021. (Credit account titles are automatically indented when amount is entered. Do no indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. For costs incurred us account Materials, Cash, Payables.) Debit Credit (To record cost of construction.) (To record progress billings.) (To record collections.) (To recognize revenue.) Compute the amount of gross profit to be recognized each year, assuming the completed-contract method is used. 2020 2021 2022 Gross profit $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts