Question: Question 13 (0.2 points) Find the expected price for a stock in one year given that shares trade at $92.82 per share right now and

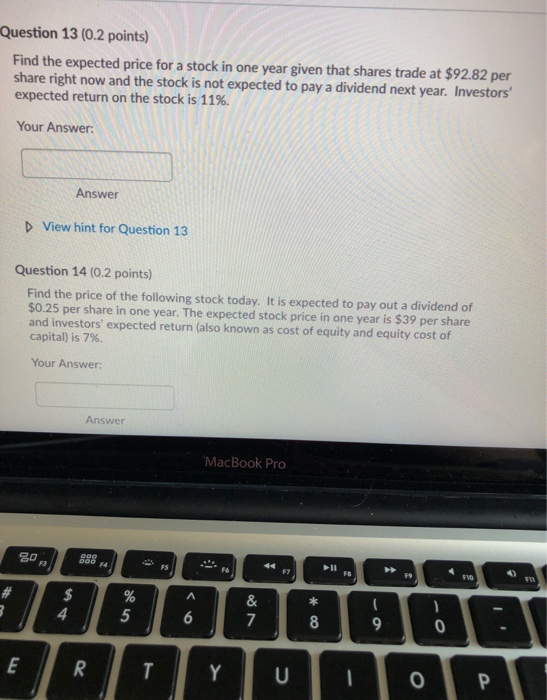

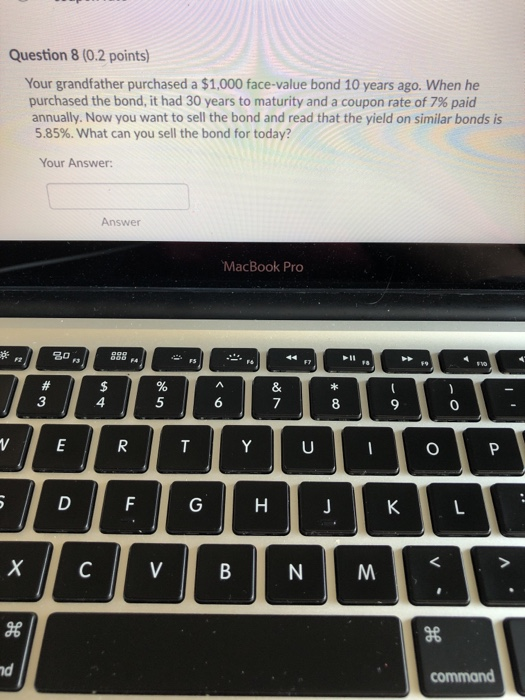

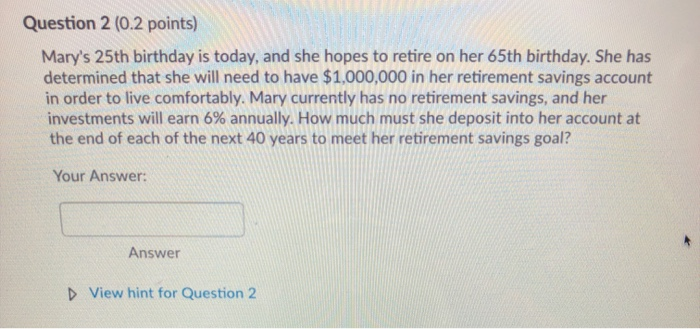

Question 13 (0.2 points) Find the expected price for a stock in one year given that shares trade at $92.82 per share right now and the stock is not expected to pay a dividend next year. Investors' expected return on the stock is 11%. Your Answer: Answer DView hint for Question 13 Question 14 (0.2 points) Find the price of the following stock today. It is expected to pay out a dividend of $0.25 per share in one year. The expected stock price in one year is $39 per share and investors' expected return (also known as cost of equity and equity cost of capital) is 7%. Your Answer: Answer MacBook Pro @GAHARI Question 8 (0.2 points) Your grandfather purchased a $1,000 face-value bond 10 years ago. When he purchased the bond, it had 30 years to maturity and a coupon rate of 7% paid annually. Now you want to sell the bond and read that the yield on similar bonds is 5.85%. What can you sell the bond for today? Your Answer: Answer MacBook Pro H command Question 2 (0.2 points) Mary's 25th birthday is today, and she hopes to retire on her 65th birthday. She has determined that she will need to have $1,000,000 in her retirement savings account in order to live comfortably. Mary currently has no retirement savings, and her investments will earn 6% annually. How much must she deposit into her account at the end of each of the next 40 years to meet her retirement savings goal? Your Answer: Answer D View hint for Question 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts