Question: Question 13 1 pts Jamaica Corp. is adding a new assembly line at a cost of $8.0 million. The form expects the project to generate

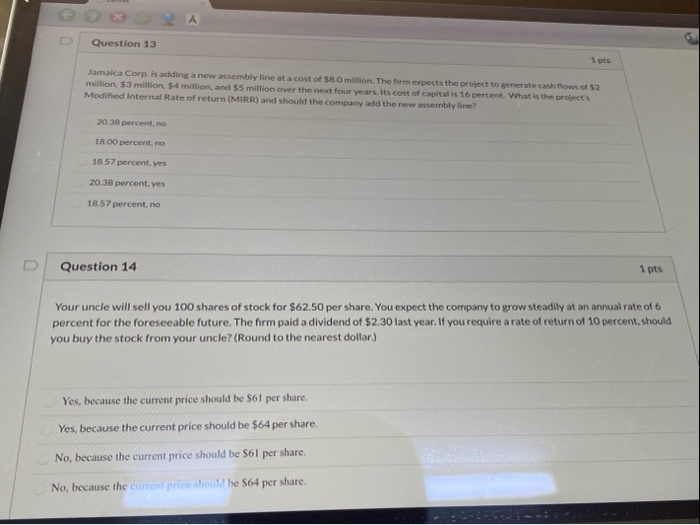

Question 13 1 pts Jamaica Corp. is adding a new assembly line at a cost of $8.0 million. The form expects the project to generate cash flows of 52 million $3 million, 54 million, and $5 million over the next four years. Its cost of capital is 16 percent. What is the project's Modified Internal Rate of return (MIRR) and should the company add the new assembly line! 20.38 percent, no 18.00 percent, no 18.57 percent. yes 20.38 percent. yes 18.57 percent, no Question 14 1 pts Your uncle will sell you 100 shares of stock for $62.50 per share. You expect the company to grow steadily at an annual rate of 6 percent for the foreseeable future. The firm paid a dividend of $2.30 last year. If you require a rate of return of 10 percent should you buy the stock from your uncle? (Round to the nearest dollar) Yes, because the current price should be $61 per share. Yes, because the current price should be $64 per share. No, because the current price should be $61 per share, No, because the current price should be $64 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts