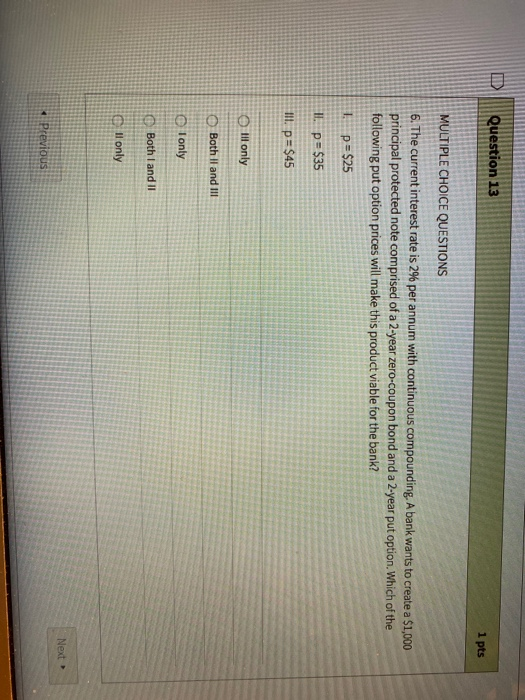

Question: Question 13 1 pts MULTIPLE CHOICE QUESTIONS 6. The current interest rate is 2% per annum with continuous compounding. A bank wants to create a

Question 13 1 pts MULTIPLE CHOICE QUESTIONS 6. The current interest rate is 2% per annum with continuous compounding. A bank wants to create a $1,000 principal protected note comprised of a 2-year zero-coupon bond and a 2-year put option. Which of the following put option prices will make this product viable for the bank? | p = $25 I. p= $35 III. p = $45 lll only Both II and III Tonly Both I and II Cll only Previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts