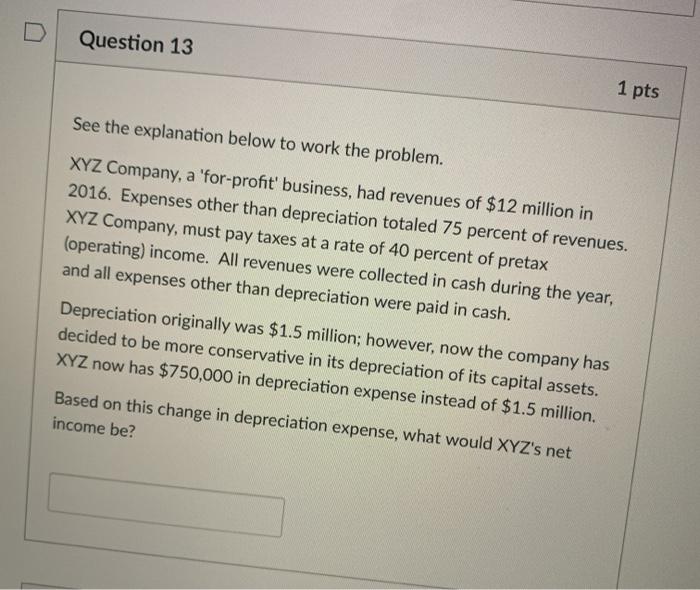

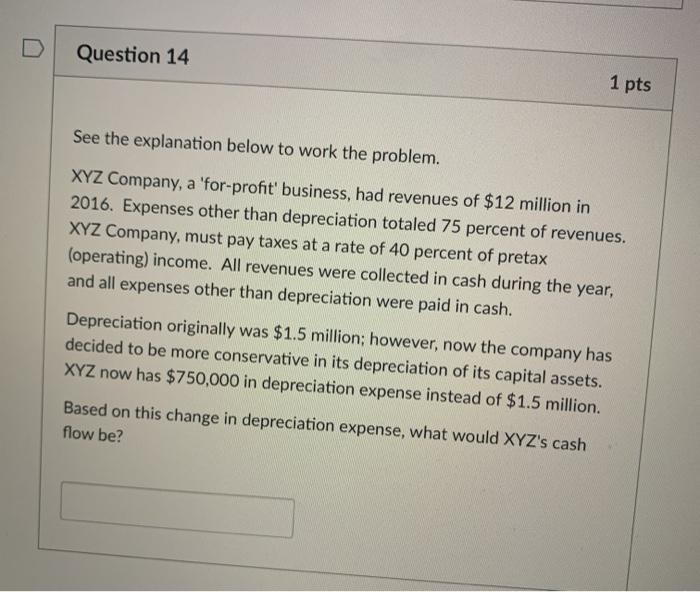

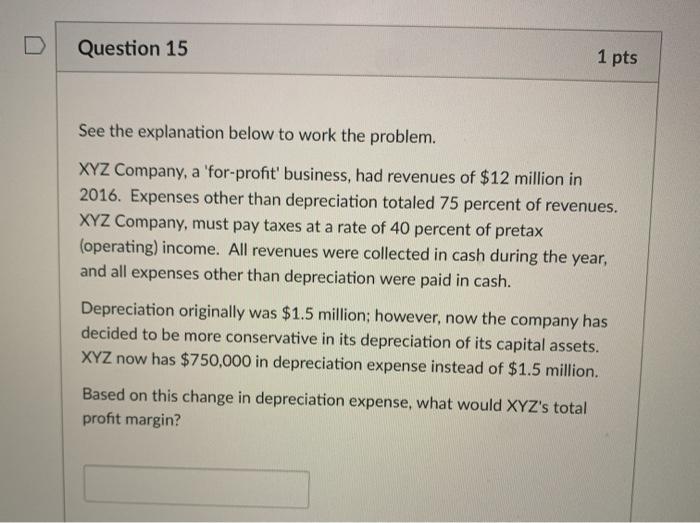

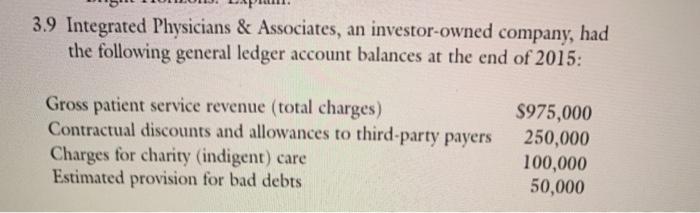

Question 13 1 pts See the explanation below to work the problem. XYZ Company, a 'for-profit' business, had revenues of $12 million in 2016. Expenses other than depreciation totaled 75 percent of revenues. XYZ Company, must pay taxes at a rate of 40 percent of pretax (operating) income. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. Depreciation originally was $1.5 million; however, now the company has decided to be more conservative in its depreciation of its capital assets. XYZ now has $750,000 in depreciation expense instead of $1.5 million. Based on this change in depreciation expense, what would XYZ's net income be? Question 14 1 pts See the explanation below to work the problem. XYZ Company, a 'for-profit' business, had revenues of $12 million in 2016. Expenses other than depreciation totaled 75 percent of revenues. XYZ Company, must pay taxes at a rate of 40 percent of pretax (operating) income. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. Depreciation originally was $1.5 million; however, now the company has decided to be more conservative in its depreciation of its capital assets. XYZ now has $750,000 in depreciation expense instead of $1.5 million. Based on this change in depreciation expense, what would XYZ's cash flow be? Question 15 1 pts See the explanation below to work the problem. XYZ Company, a 'for-profit' business, had revenues of $12 million in 2016. Expenses other than depreciation totaled 75 percent of revenues. XYZ Company, must pay taxes at a rate of 40 percent of pretax (operating) income. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. Depreciation originally was $1.5 million; however, now the company has decided to be more conservative in its depreciation of its capital assets. XYZ now has $750,000 in depreciation expense instead of $1.5 million. Based on this change in depreciation expense, what would XYZ's total profit margin? 3.9 Integrated Physicians & Associates, an investor-owned company, had the following general ledger account balances at the end of 2015: Gross patient service revenue (total charges) Contractual discounts and allowances to third-party payers Charges for charity (indigent) care Estimated provision for bad debts $975,000 250,000 100,000 50,000 Question 16 1 pts Go to page 115 in the book. Find problem 3.8. For problem 3.8, what is Bright Horizon's depreciation expense? Hint: Look at the PowerPoint Chapter 3 - Homework Prep, there is a slide that walks you through this. Question 17 1 pts Go to page 115 in the book. Find problem 3.9. For problem 3.9, what is Integrated Physicians and Associates' net patient service revenue? 675.000