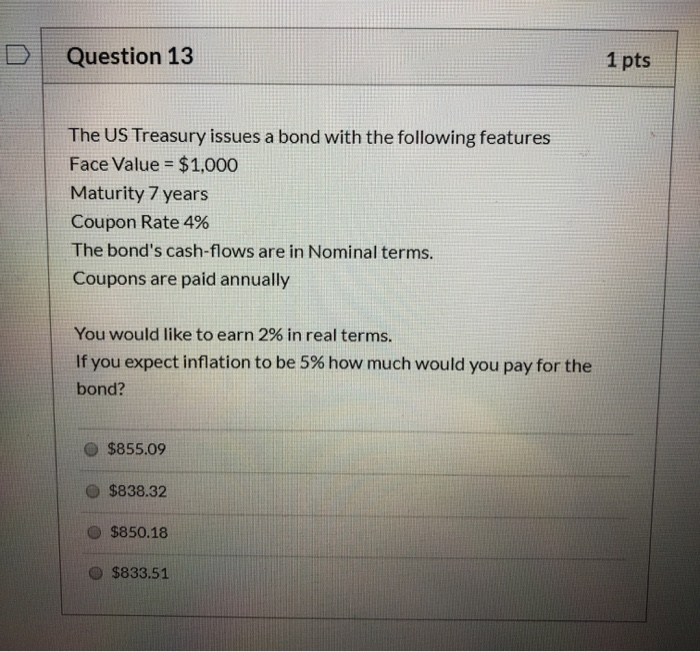

Question: Question 13 1 pts The US Treasury issues a bond with the following features Face Value = $1,000 Maturity 7 years Coupon Rate 4% The

Question 13 1 pts The US Treasury issues a bond with the following features Face Value = $1,000 Maturity 7 years Coupon Rate 4% The bond's cash-flows are in Nominal terms. Coupons are paid annually You would like to earn 2% in real terms. If you expect inflation to be 5% how much would you pay for the bond? $855.09 $838.32 $850.18 $833.51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts