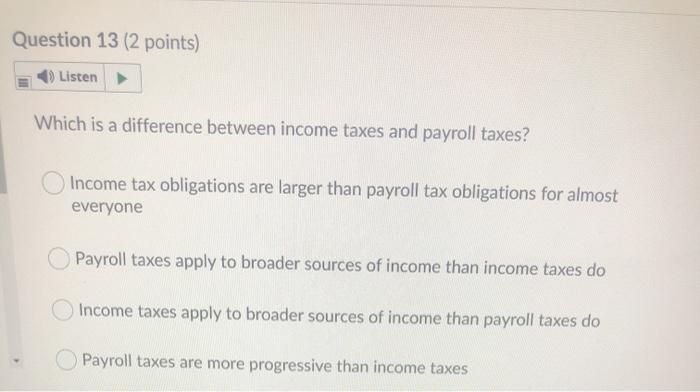

Question: Question 13 (2 points) Listen Which is a difference between income taxes and payroll taxes? Income tax obligations are larger than payroll tax obligations for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock