Question: Question 13 2 pts HCA must install a new $1.4 million computer to track patient records in its multiple service areas. It plans to use

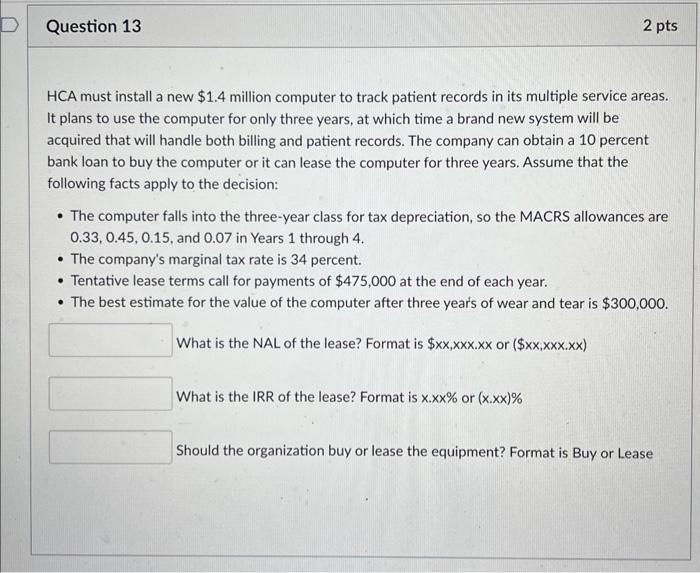

Question 13 2 pts HCA must install a new $1.4 million computer to track patient records in its multiple service areas. It plans to use the computer for only three years, at which time a brand new system will be acquired that will handle both billing and patient records. The company can obtain a 10 percent bank loan to buy the computer or it can lease the computer for three years. Assume that the following facts apply to the decision: - The computer falls into the three-year class for tax depreciation, so the MACRS allowances are 0.33,0.45,0.15, and 0.07 in Years 1 through 4. - The company's marginal tax rate is 34 percent. - Tentative lease terms call for payments of $475,000 at the end of each year. - The best estimate for the value of the computer after three year's of wear and tear is $300,000. What is the NAL of the lease? Format is $xx,xxx.xx or ($xx,xxx.xx) What is the IRR of the lease? Format is x.xx% or (x.xx)% Should the organization buy or lease the equipment? Format is Buy or Lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts