Question: Question 13 20 pts Consider an 8-month forward contract on AT&T. The current price of AT&T is $60, and a dividend of $2 is expected

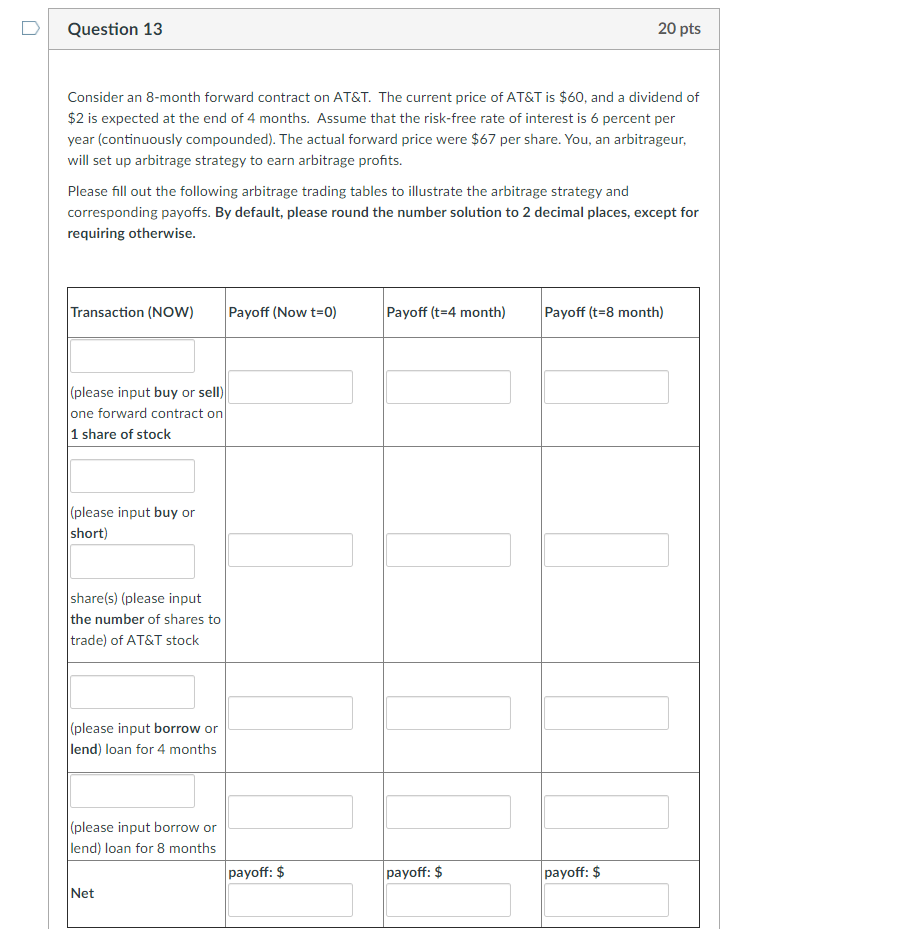

Question 13 20 pts Consider an 8-month forward contract on AT&T. The current price of AT&T is $60, and a dividend of $2 is expected at the end of 4 months. Assume that the risk-free rate of interest is 6 percent per year (continuously compounded). The actual forward price were $67 per share. You, an arbitrageur, will set up arbitrage strategy to earn arbitrage profits. Please fill out the following arbitrage trading tables to illustrate the arbitrage strategy and corresponding payoffs. By default, please round the number solution to 2 decimal places, except for requiring otherwise. Transaction (NOW) Payoff (Now t=0) Payoff (t=4 month) Payoff (t=8 month) (please input buy or sell) one forward contract on 1 share of stock (please input buy or short) share(s) (please input the number of shares to trade) of AT&T stock (please input borrow or lend) loan for 4 months (please input borrow or lend) loan for 8 months payoff: $ Net payoff: $ payoff: $ Question 13 20 pts Consider an 8-month forward contract on AT&T. The current price of AT&T is $60, and a dividend of $2 is expected at the end of 4 months. Assume that the risk-free rate of interest is 6 percent per year (continuously compounded). The actual forward price were $67 per share. You, an arbitrageur, will set up arbitrage strategy to earn arbitrage profits. Please fill out the following arbitrage trading tables to illustrate the arbitrage strategy and corresponding payoffs. By default, please round the number solution to 2 decimal places, except for requiring otherwise. Transaction (NOW) Payoff (Now t=0) Payoff (t=4 month) Payoff (t=8 month) (please input buy or sell) one forward contract on 1 share of stock (please input buy or short) share(s) (please input the number of shares to trade) of AT&T stock (please input borrow or lend) loan for 4 months (please input borrow or lend) loan for 8 months payoff: $ Net payoff: $ payoff: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts