Question: Question 13 24 points Sve A Calculate the future value of the annuity assuming that it is (1) an ordinary annuity (2) an annuity due

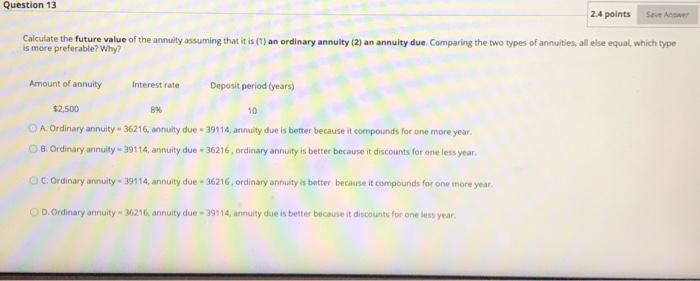

Question 13 24 points Sve A Calculate the future value of the annuity assuming that it is (1) an ordinary annuity (2) an annuity due Comparing the two types of annuities, all else equal, which type is more preferable? Why? Amount of annuity Interest rate Deposit period (years) BM 10 $2,500 A Ordinary annuity - 36216, annuity due - 39114, annuity due is better because it compounds for one more year, CB. Ordinary annuity = 39114 annuity due - 36216, ordinary annuity is better because it discounts for one less year CC.Ordinary annuity - 19114, annuity due - 36216, ordinary annuity is better because it compounds for one more year. OD. Ordinary annuity - 36216, annuity due - 39114, annuity due is better because it discounts for one less year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts