Question: Question 13 (3 points) If the market perceives new risks of PW because of increase in import depressing the wine price, and PW can only

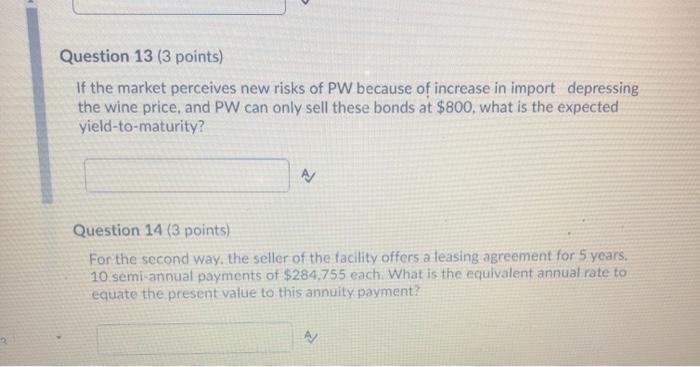

Question 13 (3 points) If the market perceives new risks of PW because of increase in import depressing the wine price, and PW can only sell these bonds at $800, what is the expected yield-to-maturity? A Question 14 (3 points) For the second way, the seller of the facility offers a leasing agreement for 5 years, 10 semi-annual payments of $284,755 each: What is the equivalent annual rate to equate the present value to this annuity payment? AJ Question 13 (3 points) If the market perceives new risks of PW because of increase in import depressing the wine price, and PW can only sell these bonds at $800, what is the expected yield-to-maturity? A Question 14 (3 points) For the second way, the seller of the facility offers a leasing agreement for 5 years, 10 semi-annual payments of $284,755 each: What is the equivalent annual rate to equate the present value to this annuity payment? AJ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts